Introduction

As we move into the new year, investors are always on the lookout for the best stocks to buy. 2017 presented a unique set of opportunities and challenges, and it’s crucial to identify those companies with strong fundamentals and growth potential. In this article, we will explore some of the top stocks to buy in the US for 2017, offering insights into their performance and future prospects.

Amazon (AMZN)

One of the standout stocks of 2017 was Amazon, which continued its impressive growth trajectory. The online retail giant saw significant gains throughout the year, driven by strong sales and expansion into new markets. With its innovative approach to e-commerce and cloud computing, Amazon remains a dominant force in the tech industry.

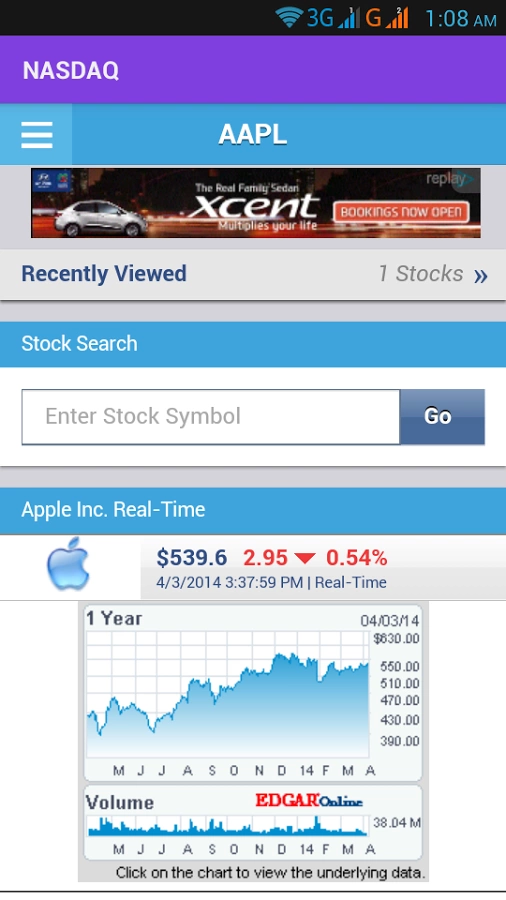

Apple (AAPL)

Apple also had a strong year in 2017, with its stock price reaching new heights. The tech giant saw robust sales of its iPhone and other products, along with significant growth in its services segment. Apple’s strong financial performance and commitment to innovation make it a solid investment choice for long-term investors.

Facebook (FB)

Facebook experienced a challenging year in 2017, with concerns over data privacy and political influence. Despite these issues, the company’s stock price remained relatively stable, and it continued to generate significant revenue from advertising. With a strong user base and a focus on improving its platform, Facebook remains a valuable investment opportunity.

Tesla (TSLA)

Tesla was another notable stock in 2017, with its shares experiencing significant volatility. The electric vehicle manufacturer saw strong sales of its Model 3, but also faced production challenges and criticism over its business practices. Despite these challenges, Tesla’s commitment to sustainable transportation and innovation make it an interesting investment for those with a high tolerance for risk.

Nike (NKE)

Nike was a standout performer in the consumer discretionary sector in 2017, driven by strong sales of its footwear and apparel. The company continued to invest in marketing and innovation, expanding its product line and reaching new markets. With a strong brand and a loyal customer base, Nike remains a solid investment choice.

Walmart (WMT)

Walmart had a mixed year in 2017, with its stock price fluctuating throughout the year. The retail giant faced increased competition from online retailers, but also made significant strides in improving its e-commerce capabilities. Walmart’s strong presence in the grocery and retail sectors, along with its commitment to innovation, make it a viable investment opportunity.

Conclusion

In 2017, investors had a variety of top stocks to choose from, each with its own unique set of strengths and challenges. By understanding the performance and future prospects of these companies, investors can make informed decisions about their investments. As we look ahead to 2018 and beyond, it’s important to stay informed and remain focused on companies with strong fundamentals and growth potential.

nasdaq 100 companies