Introduction:

The stock market has long been a barometer of economic health and investor sentiment. One of the most scrutinized periods in the US stock market is during election years. This article delves into the dynamics of the stock market during these pivotal times, exploring the historical trends, potential risks, and opportunities that arise.

Historical Trends:

Historically, the stock market tends to perform well during election years. This trend can be attributed to several factors. Firstly, investors often experience increased uncertainty during election cycles, leading to a "flight to quality" scenario, where they seek refuge in more stable assets like stocks. Secondly, the anticipation of policy changes and economic stimulus measures by incoming administrations can drive investor optimism.

Analysis of the 2016 Election:

A notable example is the 2016 election, where the stock market experienced significant volatility. Despite initial fears of market instability due to the unexpected victory of Donald Trump, the market ultimately soared to new highs. This surge can be attributed to the optimism surrounding his pro-growth policies and tax cuts.

The 2020 Election:

The 2020 election year was marked by unprecedented challenges due to the COVID-19 pandemic. Despite these challenges, the stock market demonstrated remarkable resilience. The S&P 500 index, for instance, saw its worst drop in history in March 2020 but quickly recovered, thanks to government stimulus measures and investors' confidence in the market's ability to bounce back.

Risks and Opportunities:

While election years often bring opportunities, they also come with potential risks. Political uncertainty can lead to market volatility, as seen in the 2016 election. Policy changes implemented by incoming administrations can impact various sectors of the economy, influencing stock prices.

One potential risk is tariffs and trade policies. For instance, the 2016 election saw a rise in trade tensions between the US and China, which had a significant impact on the stock market. Similarly, the 2020 election year saw investors worrying about potential trade disputes and the impact of international relations on the market.

On the other hand, infrastructure spending and tax reforms can create opportunities for certain sectors, such as construction and energy. The incoming administration's policies can also influence the tech sector, which has become a significant part of the US economy.

Case Studies:

Case Study 1: Tech Stocks in the 2020 Election Year

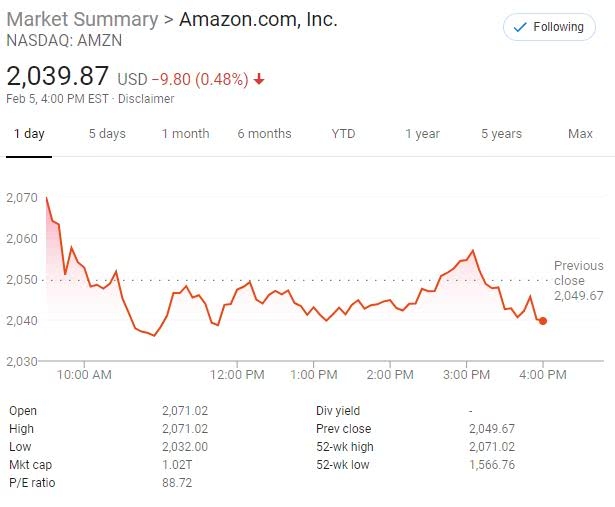

The 2020 election year saw a surge in tech stocks, driven by increased demand for remote work and e-commerce. Companies like Amazon, Apple, and Microsoft saw significant growth, showcasing the resilience and potential of the tech sector.

Case Study 2: Energy Sector in the 2016 Election Year

The energy sector experienced a boost during the 2016 election year, as investors anticipated lower taxes and increased production from the incoming administration. This optimism led to a rise in oil and gas stocks.

Conclusion:

The stock market during election years in the US is characterized by a mix of opportunities and risks. While historical trends suggest a positive outlook, investors must remain vigilant and informed about potential market shifts. By understanding the historical context, risks, and opportunities, investors can make informed decisions and navigate the complexities of the stock market during these pivotal times.

nasdaq 100 companies