Introduction

As we approach 2025, the stock market is buzzing with anticipation for several major companies planning to announce stock splits. A stock split is a corporate action where a company divides its existing shares into multiple shares, often to make the stock more accessible to retail investors. This article will explore the most anticipated stock splits in the United States for 2025, highlighting the potential impact on investors and the market as a whole.

Why Stock Splits Matter

Stock splits can have a significant impact on a company's valuation and market perception. Historically, companies that announce stock splits have seen their stock prices appreciate in the long run. Here's why:

Top Stock Splits to Watch in 2025

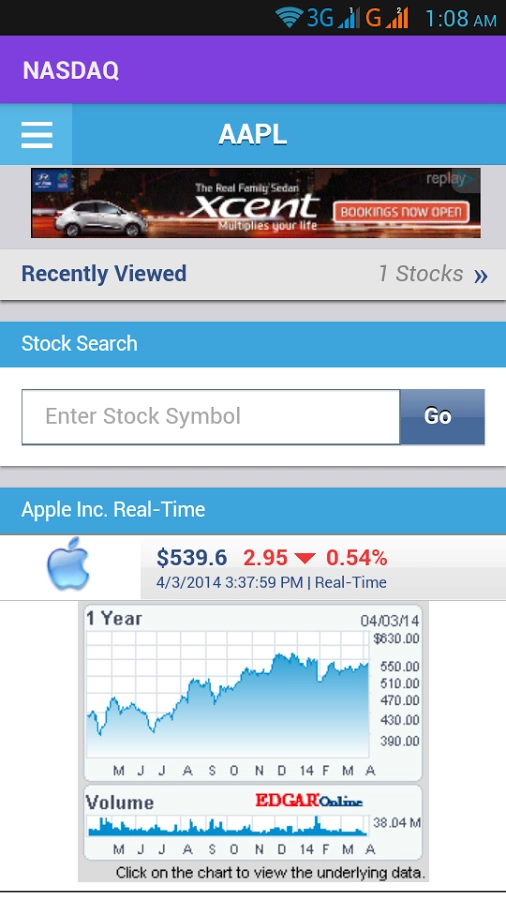

1. Apple Inc. (AAPL)

Apple is expected to announce a stock split in 2025, potentially doubling its shares. This move would make Apple's stock more accessible to a broader range of investors, while still maintaining its status as a high-growth company.

2. Microsoft Corporation (MSFT)

Microsoft has a history of stock splits, and investors are eagerly anticipating another announcement in 2025. A split could help maintain Microsoft's position as a leader in the technology industry and attract new investors.

3. Alphabet Inc. (GOOGL)

Alphabet, the parent company of Google, is another tech giant expected to announce a stock split in 2025. A split could make Alphabet's stock more attractive to retail investors and potentially drive further growth in the company's market capitalization.

4. Amazon.com Inc. (AMZN)

Amazon has seen significant growth over the years, and investors are hopeful for a stock split in 2025. A split could make Amazon's stock more accessible to a broader range of investors and further solidify its position as a market leader in e-commerce and cloud computing.

5. Visa Inc. (V)

Visa is a highly regarded financial services company with a strong track record of growth. A stock split in 2025 could make Visa's stock more accessible to retail investors and potentially drive further growth in the company's market capitalization.

Case Study: Procter & Gamble (PG)

Procter & Gamble (PG) announced a 2-for-1 stock split in 2019, which was well-received by investors. The split made PG's stock more accessible and helped maintain its position as a leader in the consumer goods industry. Since the split, PG's stock has seen significant growth, demonstrating the potential benefits of a stock split.

Conclusion

As we look ahead to 2025, the anticipation for major stock splits in the United States is palpable. Companies like Apple, Microsoft, Alphabet, Amazon, and Visa are expected to announce splits that could have a significant impact on the market. Investors should stay tuned for these announcements and consider the potential benefits of owning shares in these companies.

nasdaq 100 companies