Are you interested in expanding your investment portfolio to include Indian stocks, but you're not sure if it's possible from the United States? You're not alone. Many American investors are curious about trading Indian stocks, but they often face a range of questions and concerns. In this comprehensive guide, we'll explore whether it's possible to trade Indian stocks from the US, the process involved, and the benefits and risks associated with this type of investment.

Understanding the Possibility

The short answer is yes, you can trade Indian stocks from the US. However, there are several factors to consider, including the regulatory environment, the platforms available for trading, and the currency exchange implications.

Regulatory Environment

The Securities and Exchange Board of India (SEBI) regulates the Indian stock market. While American investors can trade Indian stocks, they must comply with SEBI's regulations. This includes registering with a SEBI-registered foreign portfolio investor (FPI) and adhering to the rules and guidelines set forth by SEBI.

Trading Platforms

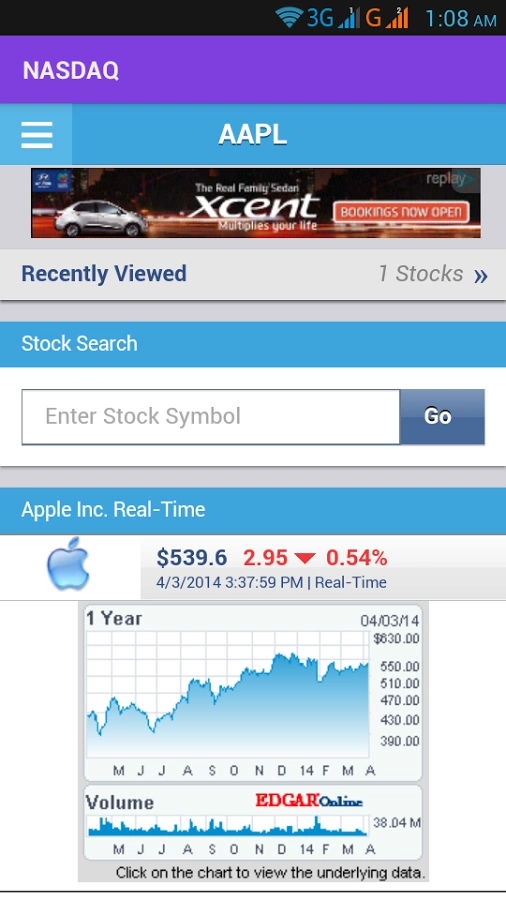

Several platforms allow American investors to trade Indian stocks. These include:

Currency Exchange Implications

Trading Indian stocks from the US involves currency exchange. When you buy or sell Indian stocks, the transaction will be conducted in Indian rupees. This means you'll need to convert your US dollars to Indian rupees, and vice versa. Be aware of the exchange rates and any fees associated with currency conversion.

Benefits of Trading Indian Stocks

Investing in Indian stocks offers several benefits, including:

Risks Associated with Trading Indian Stocks

While there are benefits to trading Indian stocks, there are also risks to consider, including:

Case Studies

To illustrate the potential of investing in Indian stocks, let's look at a few case studies:

Conclusion

Trading Indian stocks from the US is possible, but it requires careful consideration of the regulatory environment, trading platforms, and currency exchange implications. While there are risks involved, the potential for high returns and diversification makes Indian stocks an attractive option for many American investors.

nasdaq 100 companies