In the world of stock trading, one of the most crucial elements to analyze is a company's stock buyback activity. This practice, where a company repurchases its own shares from the market, can significantly impact the stock price and shareholder value. To make informed decisions, traders and investors often turn to TradingView US Stock Buyback Charts. This article delves into the significance of these charts, how to read them, and provides real-world examples to illustrate their effectiveness.

Stock buybacks are a strategic move by companies to reduce the number of outstanding shares. By doing so, the company effectively increases the value of the remaining shares, potentially leading to higher earnings per share (EPS). This is because the same profits are distributed among fewer shareholders. Additionally, buybacks can signal that a company believes its stock is undervalued and has confidence in its future prospects.

TradingView is a popular online platform that offers a wide range of tools for technical analysis. Its US Stock Buyback Chart feature allows users to visualize the buyback activity of a company over time. This can be particularly useful for identifying potential investment opportunities and understanding the sentiment behind a stock's movement.

Reading a TradingView US Stock Buyback Chart involves several key elements:

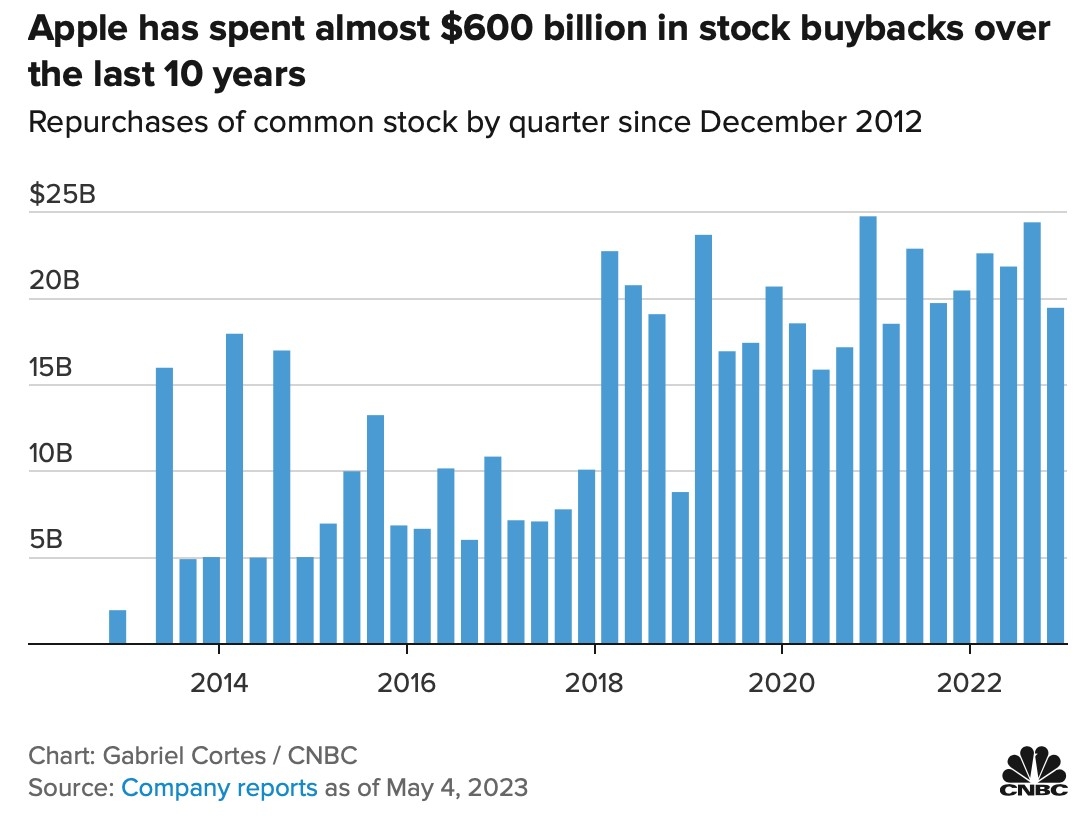

To illustrate the effectiveness of TradingView US Stock Buyback Charts, let's take a look at Apple Inc.. Over the years, Apple has been a leader in stock buybacks. By analyzing its buyback chart on TradingView, investors can see how the company's buyback activity has correlated with its stock price movements.

When Apple announced a significant increase in its buyback program in 2013, its stock price soared. This move not only increased the EPS but also sent a strong signal to the market about the company's future prospects.

TradingView US Stock Buyback Charts are an invaluable tool for investors and traders looking to gain insights into a company's stock buyback activity. By analyzing these charts, investors can better understand the company's valuation, future prospects, and market sentiment. Whether you're a seasoned investor or just starting out, incorporating these charts into your analysis can help you make more informed decisions and potentially improve your investment returns.

nasdaq 100 companies