The stock market is a dynamic and unpredictable entity, but experts are predicting a robust rise in US stocks by 2025. This article delves into the factors contributing to this optimistic outlook and examines the potential opportunities and risks that investors should be aware of.

Economic Growth and Corporate Profits

One of the primary reasons for the expected rise in US stocks is the strong economic growth and robust corporate profits. The US economy has been recovering from the COVID-19 pandemic, and many sectors are showing signs of recovery. The Federal Reserve has also been implementing policies to support economic growth, including low-interest rates and stimulus packages.

Sector-Specific Trends

Several sectors are expected to perform exceptionally well in the coming years. Technology, healthcare, and consumer discretionary sectors are among the top performers. Companies in these sectors are benefiting from increased demand and technological advancements.

Technology Sector

The technology sector has been a major driver of the US stock market's growth. Companies like Apple, Microsoft, and Amazon have seen significant growth in their revenue and market capitalization. The increasing demand for technology products and services, especially in the wake of the pandemic, has further boosted the sector's performance.

Healthcare Sector

The healthcare sector has also been a significant performer. The pandemic has highlighted the importance of healthcare, and companies in this sector have seen increased demand for their products and services. Biotech companies, pharmaceutical companies, and medical device manufacturers are expected to see significant growth in the coming years.

Consumer Discretionary Sector

The consumer discretionary sector has also been performing well. As the economy recovers, consumers are expected to spend more on non-essential items, such as travel, entertainment, and luxury goods. Companies in this sector are expected to see a surge in revenue and profits.

Risks and Challenges

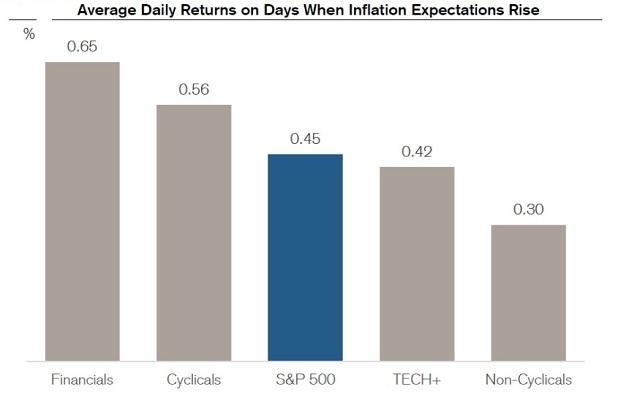

While the outlook for US stocks is optimistic, there are also risks and challenges that investors should be aware of. These include geopolitical tensions, inflation, and changes in interest rates. Investors should conduct thorough research and consider these factors before making investment decisions.

Case Studies

To illustrate the potential of US stocks, let's consider a few case studies:

Conclusion

The outlook for US stocks in 2025 is optimistic, driven by strong economic growth, robust corporate profits, and sector-specific trends. However, investors should be aware of the risks and challenges that come with investing in the stock market. Conducting thorough research and considering these factors is crucial for making informed investment decisions.

nasdaq 100 companies