The Indian IT sector has been a significant player in the global market, providing a wide range of services to multinational corporations. However, recent developments have cast a shadow over this thriving industry. As US recession fears grow, Indian IT stocks are falling, raising concerns about the future of this vital sector.

The Growing Concern

The US economy has been a major driver of the Indian IT sector, with many Indian companies relying heavily on American clients. As such, any sign of a US recession can have a significant impact on the Indian IT industry. The recent rise in US recession fears has led to a decline in Indian IT stocks, with many investors worried about the future of the sector.

Reasons for the Fall

Several factors have contributed to the fall in Indian IT stocks. One of the primary reasons is the increasing uncertainty surrounding the US economy. The Federal Reserve's aggressive interest rate hikes and the rising inflation have raised concerns about a potential recession in the US. This uncertainty has led to a decrease in business confidence, affecting the demand for IT services.

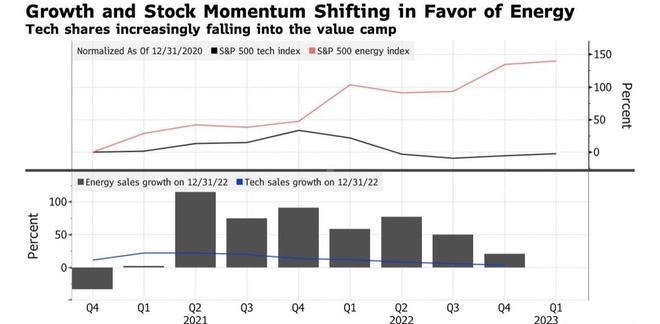

Another factor is the slowing growth in the US tech industry. Many US tech giants have recently reported lower revenue and profit forecasts, indicating a possible slowdown in the sector. This has had a ripple effect on Indian IT companies, as they rely heavily on contracts from US tech companies.

Impact on Indian IT Companies

The fall in Indian IT stocks has had a significant impact on Indian IT companies. Many of these companies have seen their market value decline, and investors are worried about their future prospects. Some of the major Indian IT companies that have been affected include TCS, Infosys, Wipro, and HCL Technologies.

Case Studies

One of the most notable examples of the impact of US recession fears on Indian IT stocks is the case of Infosys. The company, which is one of India's largest IT services providers, has seen its stock price decline significantly over the past few months. This decline can be attributed to a combination of factors, including the slowing US economy and the company's own performance issues.

Another example is Wipro, which recently reported a lower-than-expected revenue forecast. The company cited the US economic slowdown as a key factor in its revenue projection. This has led to a decline in Wipro's stock price, adding to the overall negative sentiment in the Indian IT sector.

Conclusion

The growing US recession fears have had a significant impact on the Indian IT sector, leading to a fall in Indian IT stocks. This situation has raised concerns about the future of the Indian IT industry, which has been a vital source of employment and economic growth in India. As the US economy continues to face uncertainty, it remains to be seen how the Indian IT sector will fare in the coming months.

nasdaq 100 companies