In the ever-evolving world of investments, finding undervalued stocks is akin to discovering hidden gems. This is particularly true when it comes to US dividend stocks. These stocks offer investors the dual benefits of potential capital appreciation and a regular income stream. However, not all dividend stocks are created equal. Some are genuinely undervalued, offering investors an excellent opportunity to capitalize on market inefficiencies. In this article, we delve into some of the most undervalued US dividend stocks that could be overlooked by the average investor.

What Makes a Stock Undervalued?

Before we dive into the specifics, it's essential to understand what makes a stock undervalued. An undervalued stock is one that is trading below its intrinsic value. This can be due to a variety of reasons, such as market sentiment, poor short-term performance, or a lack of analyst coverage. When a stock is undervalued, it presents a buying opportunity for investors who are willing to take a long-term view.

Top Undervalued US Dividend Stocks to Watch

Johnson & Johnson (NYSE: JNJ)

Procter & Gamble (NYSE: PG)

Exxon Mobil (NYSE: XOM)

Bank of America (NYSE: BAC)

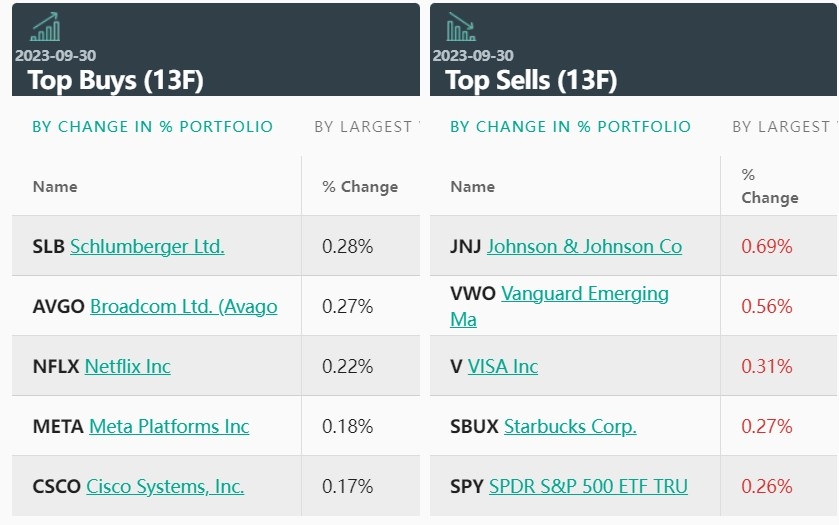

Cisco Systems (NASDAQ: CSCO)

Conclusion

Investing in undervalued US dividend stocks can be a wise decision for investors seeking long-term growth and income. By doing thorough research and understanding the factors that contribute to a stock's undervaluation, investors can identify hidden gems that could lead to significant returns. Remember, investing in the stock market involves risks, and it's crucial to conduct your due diligence before making any investment decisions.

index nasdaq 100