Introduction: Nike, the world-renowned sportswear giant, has long been a key player in the global market. With its impressive presence on the US stock exchange, investors and market enthusiasts are eager to understand the dynamics and potential of this iconic brand. In this article, we delve into the fascinating world of Nike's stock exchange journey and its impact on the market.

Understanding Nike's Stock Exchange Performance

Nike Inc. (NKE) has been listed on the New York Stock Exchange (NYSE) since 1980. Since then, the stock has experienced significant fluctuations, reflecting the company's growth trajectory and market dynamics. Understanding the key factors that influence Nike's stock performance is crucial for investors and stakeholders.

Market Dynamics and Stock Performance

1. Revenue and Earnings Growth: Nike's stock performance has been closely tied to its revenue and earnings growth. Over the years, the company has consistently outperformed its financial targets, leading to an increase in investor confidence. For instance, in the fiscal year 2021, Nike reported a revenue of $37.4 billion, marking a 9% increase from the previous year.

2. Product Innovation and Expansion: Nike's commitment to innovation and expansion has played a pivotal role in its stock performance. The company has been successful in launching new products and entering new markets, which has driven growth and attracted a broader customer base. For example, Nike's collaboration with celebrities like LeBron James and Kim Kardashian has significantly boosted its brand image and sales.

3. Brand Strength and Reputation: Nike's brand strength and reputation are unparalleled in the industry. The company has built a strong brand image through its iconic logo, quality products, and association with top athletes. This has resulted in a loyal customer base and high demand for its products, contributing to its stock's stability and growth.

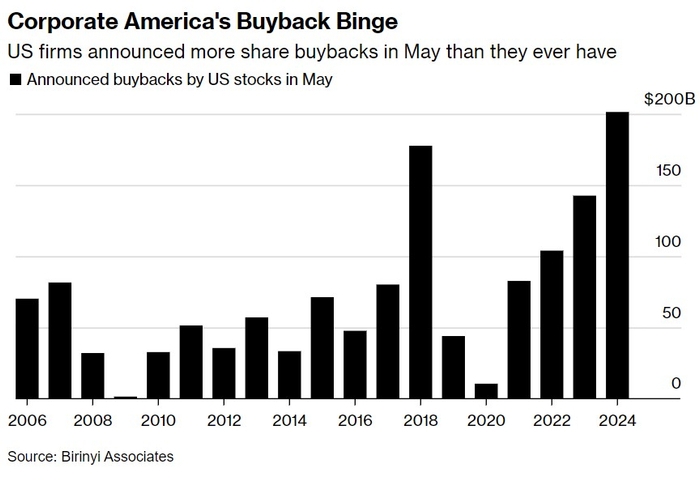

4. Dividends and Stock Buybacks: Nike has a long history of paying dividends and engaging in stock buybacks, which has further attracted investors. The company's commitment to returning value to shareholders has helped in maintaining investor confidence and enhancing its stock's appeal.

Case Studies:

1. Acquisition of Converse: In 2003, Nike acquired Converse, a legendary brand with a rich history in the sneaker industry. This acquisition not only expanded Nike's product portfolio but also strengthened its market presence. As a result, Nike's stock experienced a surge, reflecting the positive impact of the acquisition.

2. Partnership with Apple: In 2016, Nike entered a partnership with Apple, launching a series of smart sneakers equipped with Nike+ technology. This collaboration marked a significant step in integrating technology with sports, enhancing Nike's appeal to tech-savvy consumers. The partnership's success was reflected in Nike's stock performance, which witnessed a surge following the announcement.

Conclusion: Nike's presence on the US stock exchange is a testament to its growth, innovation, and brand strength. By analyzing the key factors that influence its stock performance, investors can gain a better understanding of the company's potential and make informed investment decisions. As the sportswear giant continues to evolve, its stock exchange journey will undoubtedly remain an interesting topic for investors and market enthusiasts.

index nasdaq 100