In the fast-paced world of the stock market, analyst ratings play a crucial role in shaping investor sentiment and market trends. Recent changes in these ratings have had a significant impact on US stocks, leading to both volatility and opportunities for investors. This article delves into the latest analyst rating changes and their implications for the US stock market.

Understanding Analyst Ratings

Analyst ratings are assessments provided by financial analysts regarding the future performance of a company's stock. These ratings are typically categorized as "buy," "hold," or "sell," and are based on a variety of factors, including the company's financial health, industry outlook, and market trends.

Recent Changes in Analyst Ratings

In recent months, several high-profile companies have seen significant changes in their analyst ratings. For instance, tech giant Apple Inc. (AAPL) has seen a surge in "buy" ratings, driven by strong earnings reports and a positive outlook for the future. Conversely, oil and gas company Exxon Mobil Corporation (XOM) has faced a wave of "sell" ratings, as concerns about the industry's long-term prospects have grown.

Impact on US Stocks

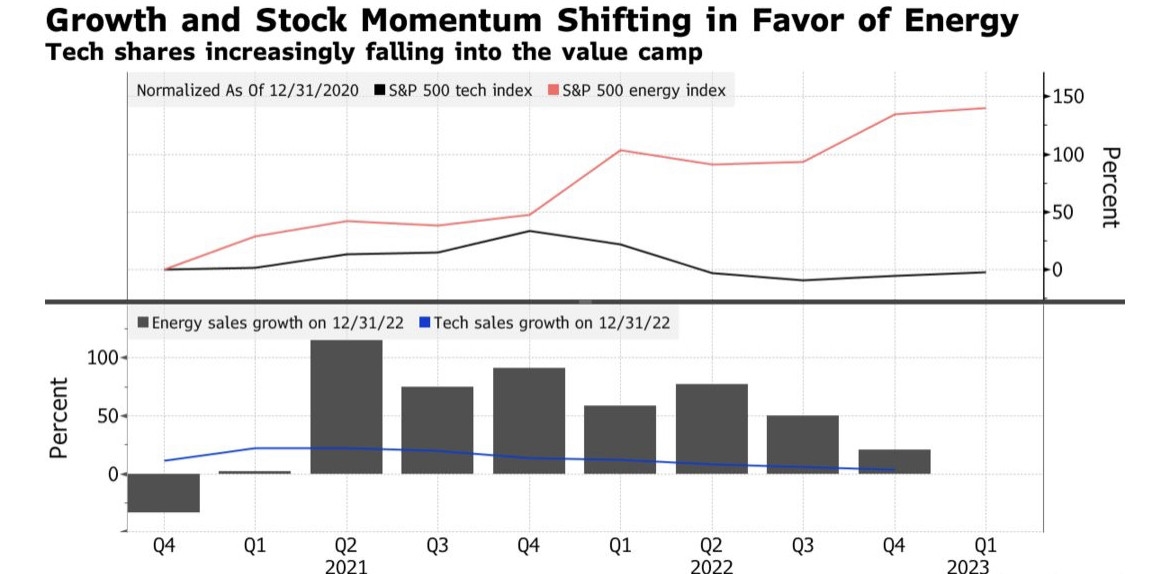

These changes in analyst ratings have had a notable impact on the US stock market. Companies with positive rating changes often see their stock prices rise, while those with negative changes may experience declines. This dynamic is particularly evident in the tech and energy sectors, where analyst ratings have been a major driver of market movements.

Case Study: Tesla, Inc. (TSLA)

One notable example is Tesla, Inc. (TSLA), the electric vehicle manufacturer. In early 2021, Tesla received a series of positive ratings from leading analysts, citing the company's strong growth prospects and innovative technology. As a result, TSLA's stock price surged, reaching an all-time high of over $1,200 per share.

Factors Influencing Analyst Ratings

Several factors can influence analyst ratings, including:

Conclusion

Recent changes in analyst ratings have had a significant impact on the US stock market. By staying informed about these changes and understanding the factors that influence them, investors can make more informed decisions and potentially capitalize on market opportunities. As the stock market continues to evolve, it's crucial to keep a close eye on analyst ratings and their implications for individual stocks and the broader market.

index nasdaq 100