In recent years, the stock markets of China and the United States have been a hot topic among investors and analysts. Both markets have their unique characteristics and advantages, making them appealing to different types of investors. This article aims to provide a comprehensive analysis of the China and US stock markets, highlighting their key differences and similarities.

Market Size and Growth

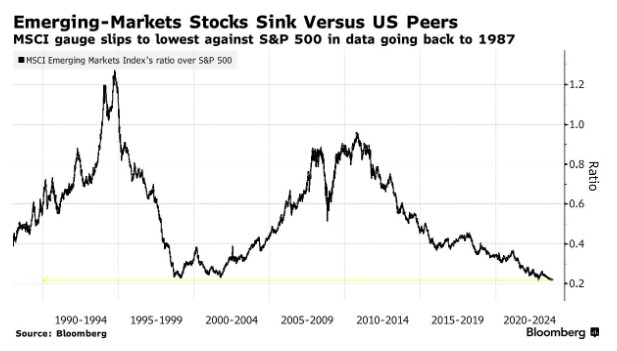

The first notable difference between the China and US stock markets is their size and growth. The US stock market is the largest in the world, with a market capitalization of over $30 trillion. The S&P 500, a widely followed index of large US companies, has experienced significant growth over the years, making it a popular choice for investors seeking exposure to the American economy.

On the other hand, the Chinese stock market has been growing rapidly, with a market capitalization of approximately $7 trillion. The Shanghai and Shenzhen stock exchanges, the two main exchanges in China, have seen a surge in trading volume and market value, making them a significant player in the global market.

Market Composition

The composition of the China and US stock markets also differs significantly. The US stock market is dominated by large-cap companies, with the S&P 500 consisting mainly of blue-chip companies such as Apple, Microsoft, and Johnson & Johnson. These companies are known for their stability and strong financial performance.

In contrast, the Chinese stock market is characterized by a higher proportion of small and mid-cap companies. This is due to the fact that the Chinese government has been actively promoting the development of the SME sector. Additionally, the Chinese market has a larger number of state-owned enterprises, which can affect the overall market dynamics.

Investment Strategies

Investing in the China and US stock markets requires different strategies. Investors in the US market often focus on long-term growth and dividends, as they tend to invest in large-cap companies that have a strong track record of profitability. On the other hand, investors in the Chinese market may be more focused on short-term gains, as the market is more volatile and subject to regulatory changes.

Regulatory Environment

The regulatory environment in the China and US stock markets also differs significantly. The US market is known for its transparency and strong investor protection laws. The Securities and Exchange Commission (SEC) plays a crucial role in ensuring that companies comply with financial reporting and disclosure requirements.

In contrast, the Chinese market has faced criticism for its lack of transparency and investor protection. However, the Chinese government has been taking steps to improve the regulatory framework, including the establishment of the China Securities Regulatory Commission (CSRC) and the implementation of stricter corporate governance standards.

Case Studies

To illustrate the differences between the China and US stock markets, let's consider two case studies: Alibaba Group and Apple Inc.

Alibaba Group, a leading e-commerce and cloud computing company based in China, has been a significant player in the Chinese stock market. Its shares are listed on the New York Stock Exchange (NYSE), making it accessible to global investors. However, the company has faced challenges related to its regulatory environment and corporate governance, which have affected its stock performance.

Apple Inc., a multinational technology company based in the United States, is a prominent example of a large-cap company in the US stock market. Its shares are listed on the NASDAQ, and the company has a strong reputation for innovation and profitability. Apple's stock has consistently performed well over the years, making it a popular investment choice for long-term investors.

Conclusion

In conclusion, the China and US stock markets offer distinct opportunities and challenges for investors. Understanding the key differences and similarities between these markets is crucial for making informed investment decisions. As the global economy continues to evolve, both markets are likely to play an increasingly important role in the global financial landscape.

index nasdaq 100