In today's interconnected financial world, stock ownership has become a significant aspect of American life. The question "How many U.S. citizens own stocks?" is not just about numbers but also about understanding the financial landscape of the nation. This article delves into the statistics, trends, and factors influencing stock ownership in the United States.

The Current Landscape

According to a report by the Federal Reserve, as of 2021, approximately 56% of U.S. households owned stocks, either directly or indirectly through mutual funds, retirement accounts, or other investment vehicles. This figure is up from 52% in 2019, reflecting a growing trend of Americans participating in the stock market.

Direct Ownership vs. Indirect Ownership

It's important to differentiate between direct and indirect stock ownership. Direct ownership refers to individuals purchasing stocks of individual companies, while indirect ownership involves owning stocks through mutual funds, exchange-traded funds (ETFs), or retirement accounts.

The majority of U.S. citizens own stocks indirectly. Retirement accounts, such as 401(k)s and IRAs, are the most common vehicles for indirect stock ownership. These accounts are designed to provide long-term savings for retirement and often include a mix of stocks, bonds, and other investments.

Demographics of Stock Ownership

The demographics of stock ownership in the United States vary widely. Higher-income households are more likely to own stocks, with 84% of households with an annual income of

Younger Americans are also less likely to own stocks compared to older generations. However, there is a growing trend of younger investors entering the stock market, driven by platforms like Robinhood and the ease of online trading.

Factors Influencing Stock Ownership

Several factors contribute to the increasing number of U.S. citizens owning stocks:

Case Study: The Great Recession

The Great Recession of 2008-2009 had a significant impact on stock ownership in the United States. Many Americans lost their investments, leading to a decrease in stock ownership. However, since then, the stock market has recovered, and the number of stock owners has increased.

Conclusion

The number of U.S. citizens owning stocks has reached an all-time high, reflecting the growing financial literacy and participation in the stock market. While there are still disparities in stock ownership based on income and age, the overall trend is positive. As the economy continues to grow and technology evolves, it's likely that even more Americans will join the ranks of stock owners.

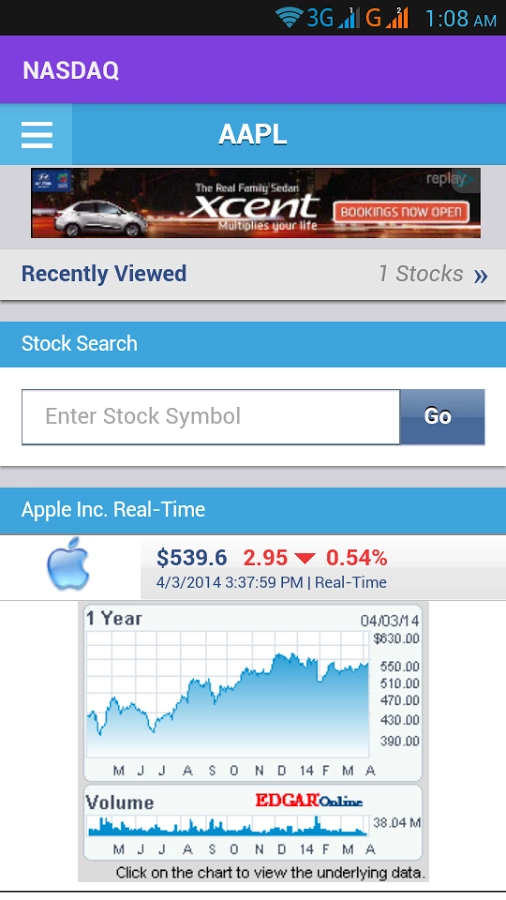

index nasdaq 100