In the fast-paced world of the stock market, identifying cheap momentum stocks can be a game-changer for investors looking to maximize returns. The term "cheap momentum stocks" refers to stocks that are currently undervalued but exhibit strong upward price momentum. In this article, we will delve into the characteristics of these stocks and discuss how investors in the US can leverage this knowledge to make informed decisions.

Understanding Cheap Momentum Stocks

Firstly, it's important to understand the two key components of "cheap momentum stocks": "cheap" and "momentum."

Cheap: This refers to stocks that are currently trading at a price significantly lower than their intrinsic value. These stocks often have a low price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, or price-to-sales (P/S) ratio.

Momentum: This describes the tendency of a stock's price to move in one direction over a certain period of time. Stocks with momentum tend to see their prices rise rapidly, often driven by positive news, strong earnings reports, or increased institutional buying.

Finding Cheap Momentum Stocks in the US

When searching for cheap momentum stocks in the US, investors should consider the following steps:

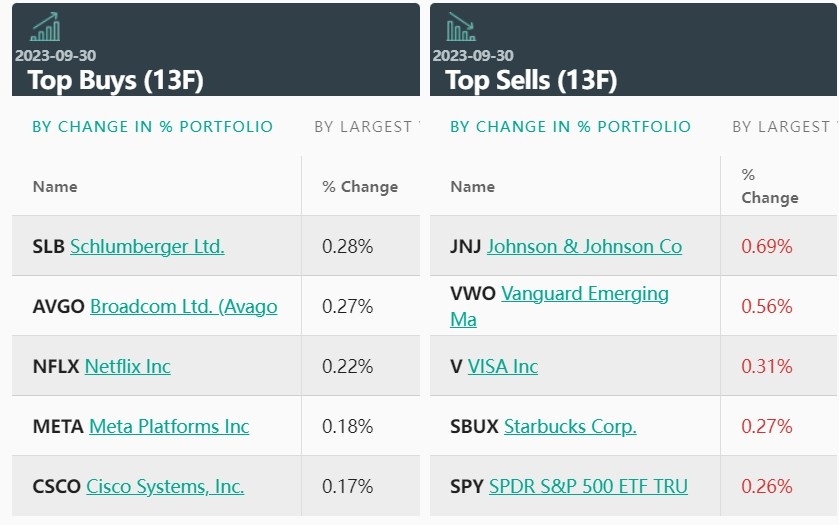

Screening: Utilize financial websites and software to screen for stocks that meet specific criteria, such as a low P/E ratio, high trading volume, and positive earnings surprises.

Research: Analyze the fundamentals of the companies that meet the screening criteria. Look for signs of strong revenue growth, improving profitability, and a competitive edge in their industry.

Technical Analysis: Incorporate technical analysis to identify stocks that are showing strong momentum. Look for patterns such as a bullish trend line, positive MACD (Moving Average Convergence Divergence) signal, or a break above resistance levels.

Case Study: Netflix, Inc. (NFLX)

One notable example of a cheap momentum stock in the US is Netflix, Inc. (NFLX). Despite facing competition from streaming giants like Disney and Amazon, Netflix has managed to maintain its position as a market leader. Here's how Netflix fits the criteria for a cheap momentum stock:

Intrinsic Value: Netflix has a low P/E ratio of around 20, significantly lower than its industry average. This suggests that the stock is undervalued.

Momentum: The stock has seen strong upward momentum over the past year, with a 50% increase in its price.

Fundamentals: Netflix has consistently reported positive earnings growth, driven by subscriber growth and revenue diversification.

Conclusion

Investing in cheap momentum stocks in the US requires a combination of fundamental analysis and technical analysis. By identifying stocks that are undervalued but exhibit strong momentum, investors can capitalize on market inefficiencies and potentially achieve substantial returns. However, it's crucial to conduct thorough research and be prepared to ride out any short-term volatility.

index nasdaq 100