Are you considering investing in US Bancorp (USB) stock? If so, it's crucial to stay updated with the latest market trends and company performance. This article delves into the current state of US Bancorp stock and provides insights into what investors should know.

Understanding US Bancorp Stock

US Bancorp, one of the leading financial institutions in the United States, is known for its diversified business segments and solid financial performance. As of today, the company's stock (USB) is trading on the New York Stock Exchange (NYSE). Let's take a closer look at the current state of USB stock.

Market Performance

As of the latest market data, USB stock has been experiencing a steady growth trend over the past few months. This upward momentum can be attributed to several factors, including the company's strong financial performance and the overall improvement in the financial industry.

Financial Highlights

Market Trends

Several market trends are currently impacting USB stock. Here are a few key factors to consider:

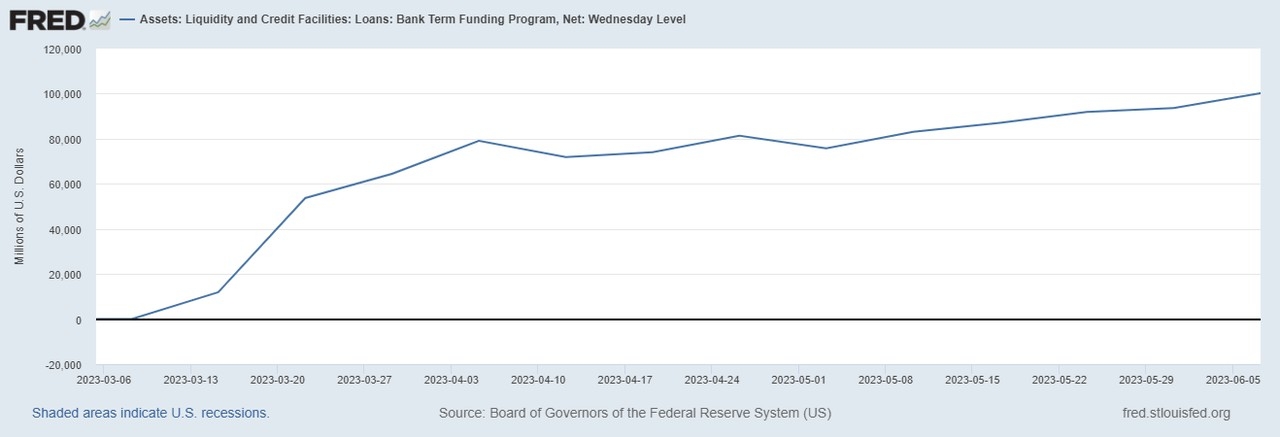

Case Study: USB Stock Performance in 2023

To illustrate the recent performance of USB stock, let's look at the following example:

This case study highlights the strong performance of USB stock in the first half of 2023, driven by the company's solid financial performance and market trends.

Conclusion

In conclusion, US Bancorp (USB) stock appears to be a solid investment opportunity for investors seeking growth and income. However, it's crucial to stay informed about market trends and the company's financial performance to make well-informed investment decisions.

Remember to consult with a financial advisor before making any investment decisions. Stay tuned for updates on USB stock and other financial news.

general electric company stock