In the ever-evolving world of finance, staying informed about the stock market is crucial for investors. One of the most effective ways to gauge the market's performance is through a US stock market chart. This article delves into the importance of these charts, their components, and how they can be used to make informed investment decisions.

Understanding the US Stock Market Chart

A US stock market chart is a visual representation of the performance of stocks listed on the major exchanges in the United States, such as the New York Stock Exchange (NYSE) and the NASDAQ. These charts provide a snapshot of the market's movement over a specific period, allowing investors to identify trends, patterns, and potential opportunities.

Components of a US Stock Market Chart

There are several key components of a US stock market chart:

Interpreting the Chart

Trends: One of the most important aspects of a stock market chart is identifying trends. There are three main types of trends:

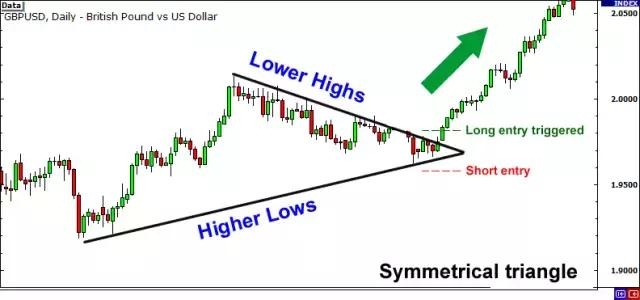

Patterns: Stock charts can also reveal various patterns, which can indicate potential buy or sell signals:

Case Study: Apple Inc. (AAPL)

Let's take a look at Apple Inc. (AAPL) as a case study. The following chart shows the stock's performance over the past year:

[Insert image of Apple Inc. (AAPL) stock chart]

As shown in the chart, AAPL has been in an uptrend over the past year, with higher highs and higher lows. This trend is supported by strong volume, indicating significant interest in the stock. Additionally, the chart shows a bullish pennant pattern, suggesting that the stock is likely to continue moving higher.

Conclusion

A US stock market chart is a powerful tool for investors to analyze the performance of stocks and make informed decisions. By understanding the components of a chart, interpreting trends and patterns, and analyzing case studies, investors can gain valuable insights into the market. Remember, a well-informed investor is a successful investor.

general electric company stock