The Wall Street Market Closes: What You Need to Know

The Wall Street market closed yesterday with a mix of emotions and significant movements. Investors and traders are analyzing the latest market trends and making informed decisions for the upcoming trading sessions. This article provides an in-depth analysis of the market close, key insights, and potential future directions.

Market Summary

Yesterday's trading session began with a cautious opening, as investors awaited the release of critical economic data. The market experienced a strong rally in the morning, driven by positive economic indicators and investor optimism. However, as the day progressed, concerns about global economic uncertainty led to a slight pullback.

Key Highlights

Economic Indicators: The latest jobs report showed a strong increase in employment, which provided a positive outlook for the economy. However, the consumer spending data revealed a slowdown, raising concerns about consumer confidence.

Tech Stocks: Tech stocks played a significant role in the market's movement. The rise of artificial intelligence and 5G technologies fueled investor interest, leading to a surge in tech stocks.

International Markets: The global market sentiment was a major factor influencing the Wall Street close. The European markets experienced a volatile session, while the Asian markets closed with mixed results.

Sector Performance

Technology: The technology sector saw the highest gains, with a significant increase in semiconductor and software stocks.

Financials: The financial sector experienced moderate gains, driven by strong earnings reports from major banks.

Energy: The energy sector closed lower, as concerns about global oil demand and supply disruptions continued to impact the market.

Analysts' Insights

Economic Growth: Analysts believe that the strong jobs report indicates a positive outlook for economic growth. However, they also emphasize the need to monitor consumer spending and inflation.

Tech Stocks: The surge in tech stocks is expected to continue, with a focus on companies that are leading the way in artificial intelligence and 5G technologies.

Global Market Sentiment: The global market sentiment remains a key factor influencing the Wall Street market. Investors are closely monitoring geopolitical developments and trade negotiations.

Case Study: Amazon's Stock Performance

One notable case study is Amazon's stock performance. The tech giant experienced a significant surge, driven by its strong earnings report and long-term growth prospects. This highlights the importance of analyzing individual company performance in the context of the broader market trends.

Conclusion

The Wall Street market close provided valuable insights into the current market conditions and potential future directions. Investors and traders are closely monitoring key economic indicators, sector performance, and global market sentiment to make informed decisions. As the market continues to evolve, it is crucial to stay informed and adapt to the changing dynamics.

Note: This article is for informational purposes only and does not constitute financial advice.

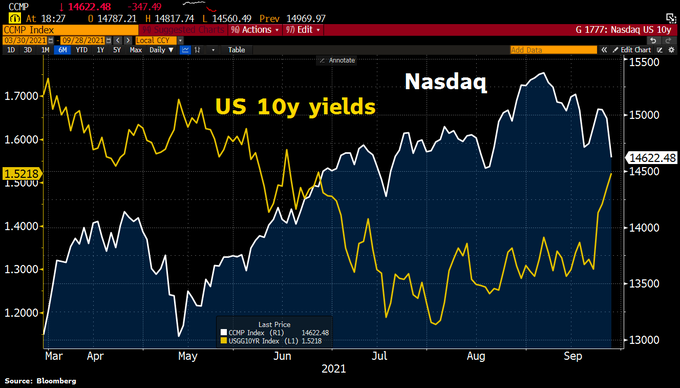

nasdaq 100 companies