In the bustling world of finance, US Pharma Stocks have always been a hot topic among investors. The pharmaceutical industry plays a crucial role in our lives, offering life-saving treatments and improving the quality of life for millions. This article aims to provide a comprehensive guide to US pharma stocks, highlighting their potential and the factors that investors should consider.

Understanding the Pharma Industry

The pharmaceutical industry encompasses the research, development, manufacturing, and distribution of drugs. It is a highly regulated sector, with strict guidelines and safety protocols. The industry is driven by the need to develop new and effective treatments for various diseases, making it a vital component of global healthcare.

Top US Pharma Stocks to Watch

Johnson & Johnson (JNJ): A leading healthcare company with a diverse portfolio of pharmaceuticals, medical devices, and consumer health products. JNJ has a strong presence in the global market and is known for its innovation and commitment to improving patient care.

Pfizer Inc. (PFE): A global pharmaceutical giant, Pfizer is renowned for its cutting-edge research and development. The company has a robust pipeline of new drugs and partnerships with other pharmaceutical companies, making it a solid investment choice.

Merck & Co., Inc. (MRK): Merck is a leader in the pharmaceutical industry, with a focus on oncology, immunology, and cardiovascular diseases. The company has a strong presence in both the US and international markets, making it a stable investment option.

AbbVie Inc. (ABBV): AbbVie is a biopharmaceutical company specializing in immunology, virology, neuroscience, and women's health. The company's innovative drugs and partnerships with other pharmaceutical companies have made it a compelling investment choice.

Factors to Consider When Investing in US Pharma Stocks

Pipeline of New Drugs: A strong pipeline of new drugs indicates that the company is committed to research and development. This can lead to future growth and increased profitability.

Regulatory Approval: The approval process for new drugs is rigorous and time-consuming. Companies with a high success rate in obtaining regulatory approval are more likely to be successful investors.

Market Position and Competition: The market position of a pharmaceutical company and its competitive advantage are crucial factors to consider. Companies with a strong market position and a competitive edge are more likely to succeed in the long term.

Financial Performance: Evaluate the financial performance of a pharmaceutical company, including revenue, profit margins, and debt levels. Companies with strong financial performance are more likely to be successful investors.

Case Study: Gilead Sciences (GILD)

Gilead Sciences is a prime example of a successful pharmaceutical company. The company has a strong pipeline of new drugs, a high success rate in regulatory approval, and a competitive edge in the market. Gilead's financial performance is also impressive, with strong revenue growth and profit margins.

Conclusion

Investing in US Pharma Stocks can be a lucrative opportunity for investors. However, it is essential to conduct thorough research and consider various factors before making investment decisions. By understanding the pharmaceutical industry, analyzing key companies, and evaluating important factors, investors can make informed decisions and potentially benefit from the growth and profitability of the pharmaceutical sector.

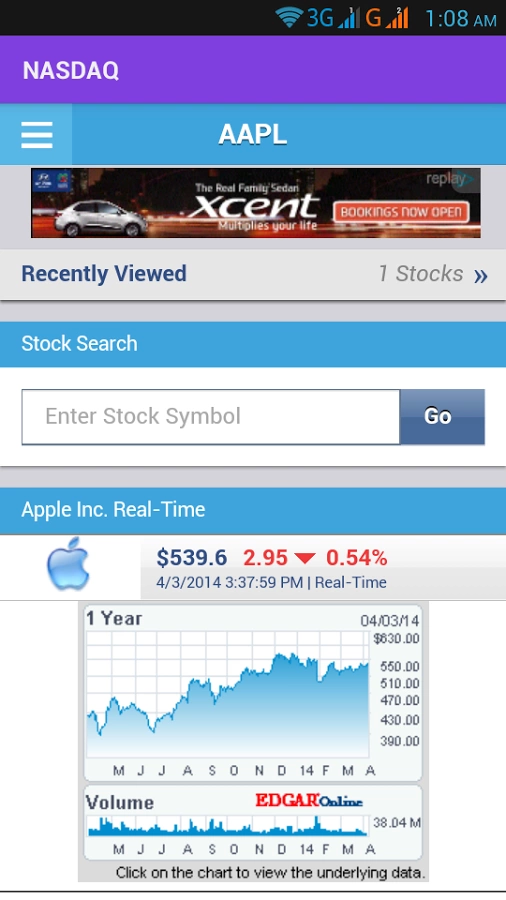

nasdaq 100 companies