Are you an investor looking to maximize your returns from the stock market? Understanding the nuances of the US stock capital gain tax is crucial. This article delves into the basics, implications, and strategies for managing capital gains taxes on your investments. Whether you're a seasoned investor or just starting out, this guide will equip you with the knowledge you need.

What is a Capital Gain?

A capital gain occurs when you sell an investment for more than its original purchase price. This could be a stock, real estate, or any other asset that has appreciated in value. The difference between the sale price and the purchase price is considered your capital gain and is subject to taxation.

Types of Capital Gains

There are two types of capital gains: short-term and long-term.

Calculating Capital Gains Tax

To calculate your capital gains tax, you'll need to determine the total amount of your capital gains, the holding period of the investment, and your applicable tax rate.

For example, if you bought 100 shares of a stock for

Strategies for Managing Capital Gains Tax

Case Studies

Conclusion

Understanding the US stock capital gain tax is essential for investors looking to maximize their returns. By knowing the types of capital gains, how to calculate taxes, and implementing strategies for managing these taxes, you can make informed investment decisions. Remember, the key to minimizing capital gains tax is planning and strategy.

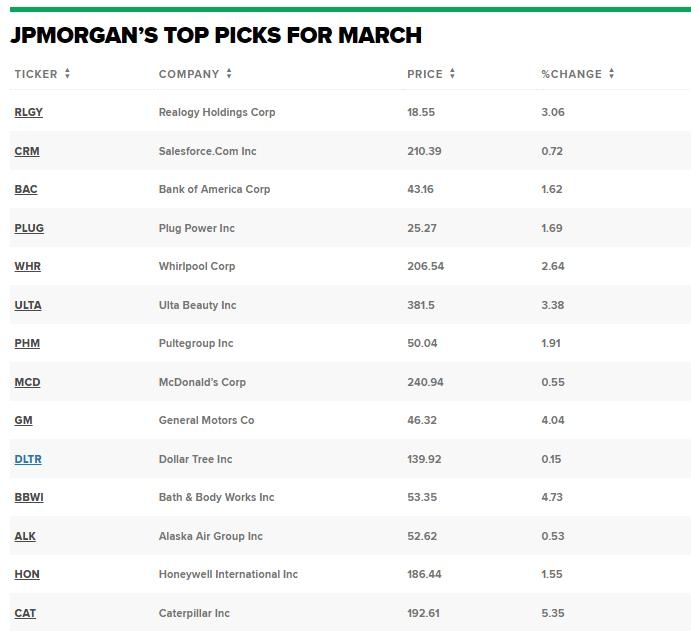

nasdaq 100 companies