Are you considering investing in the US stock market? If so, you're not alone. With its vast array of opportunities and potential for high returns, many investors are looking to the US stock market for their next big investment. But is now the right time to buy? Let's dive into the details and find out.

Understanding the US Stock Market

The US stock market is one of the largest and most liquid in the world. It's home to some of the most well-known and successful companies, including Apple, Microsoft, and Amazon. Investing in the US stock market can offer several benefits, such as:

Is Now the Right Time to Buy?

Determining whether now is the right time to buy stocks can be challenging. However, there are several factors to consider:

1. Economic Indicators

Economic indicators, such as GDP growth, unemployment rates, and inflation, can provide valuable insights into the overall health of the economy. A strong economy can lead to higher corporate earnings and, in turn, higher stock prices.

2. Market Valuations

Market valuations, such as the price-to-earnings (P/E) ratio, can help you determine whether stocks are overvalued or undervalued. A P/E ratio below 15-20 is generally considered undervalued, while a ratio above 20-25 is considered overvalued.

3. Industry Trends

Investing in industries with strong growth potential can lead to higher returns. For example, industries such as technology, healthcare, and renewable energy are currently experiencing rapid growth.

4. Company Fundamentals

Analyzing a company's financial statements, such as its revenue, profit margins, and debt levels, can help you determine its long-term prospects.

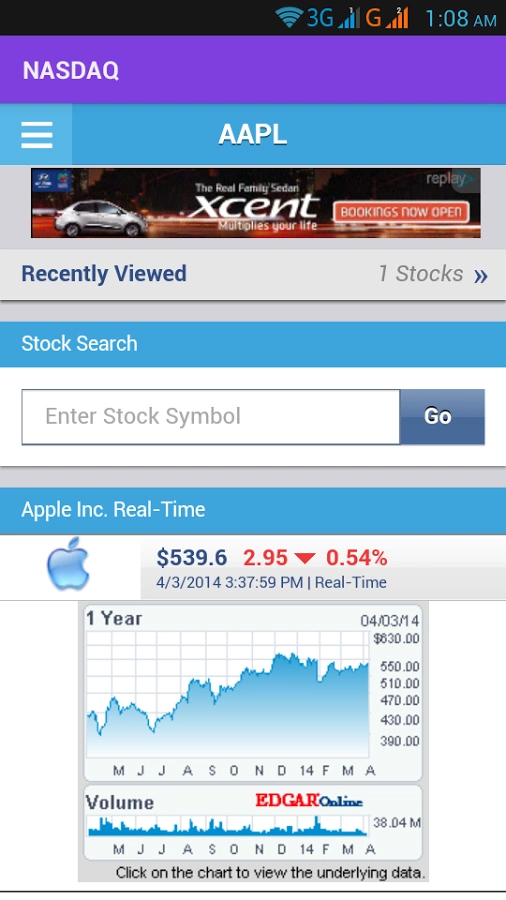

Case Study: Apple Inc.

Let's take a look at a real-world example. Apple Inc. (AAPL) is one of the most successful companies in the world, with a market capitalization of over $2 trillion. Over the past decade, Apple's stock has seen significant growth, with a P/E ratio ranging from 15 to 40.

Despite the high P/E ratio, many investors consider Apple a good investment due to its strong fundamentals, innovative products, and dominant market position. By analyzing the company's financial statements and industry trends, investors can make an informed decision about whether to buy Apple stock.

Conclusion

Investing in the US stock market can be a great way to grow your wealth. However, it's important to conduct thorough research and consider various factors before making a decision. By understanding the market, analyzing economic indicators, and evaluating company fundamentals, you can make a more informed investment decision. Whether now is the right time to buy depends on your own financial goals, risk tolerance, and investment strategy.

nasdaq 100 companies