Introduction

The world of penny stocks is often shrouded in mystery and skepticism. However, for investors looking for high returns with a lower risk profile, US penny stocks with dividends can be a game-changer. These stocks, typically priced below $5 per share, offer a unique blend of potential and risk. This article delves into the world of US penny stocks with dividends, exploring their benefits, risks, and how to identify the best opportunities.

Understanding Dividends in Penny Stocks

Dividends are payments made by a company to its shareholders, typically out of its profits. While many penny stocks do not pay dividends, some do offer this attractive feature. Companies that pay dividends tend to be more stable and mature, making them less risky compared to their non-dividend-paying counterparts.

Benefits of Investing in US Penny Stocks with Dividends

Potential for High Returns: US penny stocks with dividends can offer significant returns on investment. For example, a company with a $1 stock price that pays a 10% dividend yields a 10% return on investment, regardless of the stock's price movement.

Stability and Maturity: Companies that pay dividends tend to be more stable and mature, which can reduce the risk of investing in penny stocks.

Income Generation: Dividends can provide a regular stream of income, making US penny stocks with dividends an attractive option for income investors.

Risks of Investing in US Penny Stocks with Dividends

High Volatility: Penny stocks are known for their high volatility, which can lead to significant price swings.

Lack of Regulation: Many penny stocks are not subject to the same level of regulation as larger companies, which can increase the risk of fraud and manipulation.

Liquidity Issues: Penny stocks may have low trading volumes, making it difficult to buy or sell shares at desired prices.

How to Identify the Best US Penny Stocks with Dividends

Research: Conduct thorough research on the company's financials, industry, and management team. Look for companies with a strong track record and a solid business model.

Dividend Yield: Look for companies with a high dividend yield relative to their stock price. However, be cautious of companies with unusually high dividend yields, as they may be trying to attract investors.

Market Trends: Keep an eye on market trends and economic indicators that can impact the performance of penny stocks.

Case Study: ABC Corporation

ABC Corporation is a US-based technology company that has been paying dividends for the past five years. The company has a strong track record of profitability and innovation, and its stock price has doubled in the past year. With a dividend yield of 5%, ABC Corporation is an example of a US penny stock with dividends that offers both potential for capital gains and income generation.

Conclusion

US penny stocks with dividends can be a lucrative investment opportunity for those willing to do their homework and manage the associated risks. By conducting thorough research and staying informed about market trends, investors can identify the best opportunities and potentially achieve significant returns.

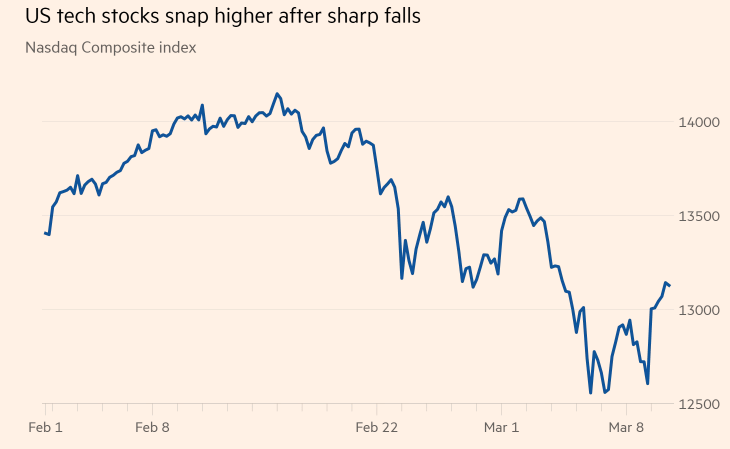

nasdaq 100 companies