The ongoing US-China trade talks have been a hot topic in the financial world, and for good reason. The relationship between the two largest economies in the world has a significant impact on global markets and stocks. In this article, we will delve into the key aspects of these trade negotiations and how they are affecting the markets.

The Trade War and Its Effects

The trade war between the US and China began in 2018, with both countries imposing tariffs on each other's goods. This has led to a decrease in trade volume and has had a negative impact on the global economy. The trade war has caused uncertainty in the markets, leading to volatility and a decline in stock prices.

Recent Developments in the Trade Talks

In recent months, there have been signs of progress in the trade talks. Both sides have shown a willingness to reach a deal, and there have been reports of potential compromises. The US and China have agreed to reduce tariffs and address intellectual property issues, which are significant steps towards resolving the trade dispute.

Impact on Markets

The news of progress in the trade talks has had a positive impact on the markets. Stock markets around the world have rallied, with the S&P 500 and the NASDAQ seeing significant gains. This is because investors are optimistic about the prospects of a trade deal, which could lead to increased trade volume and economic growth.

Impact on Stocks

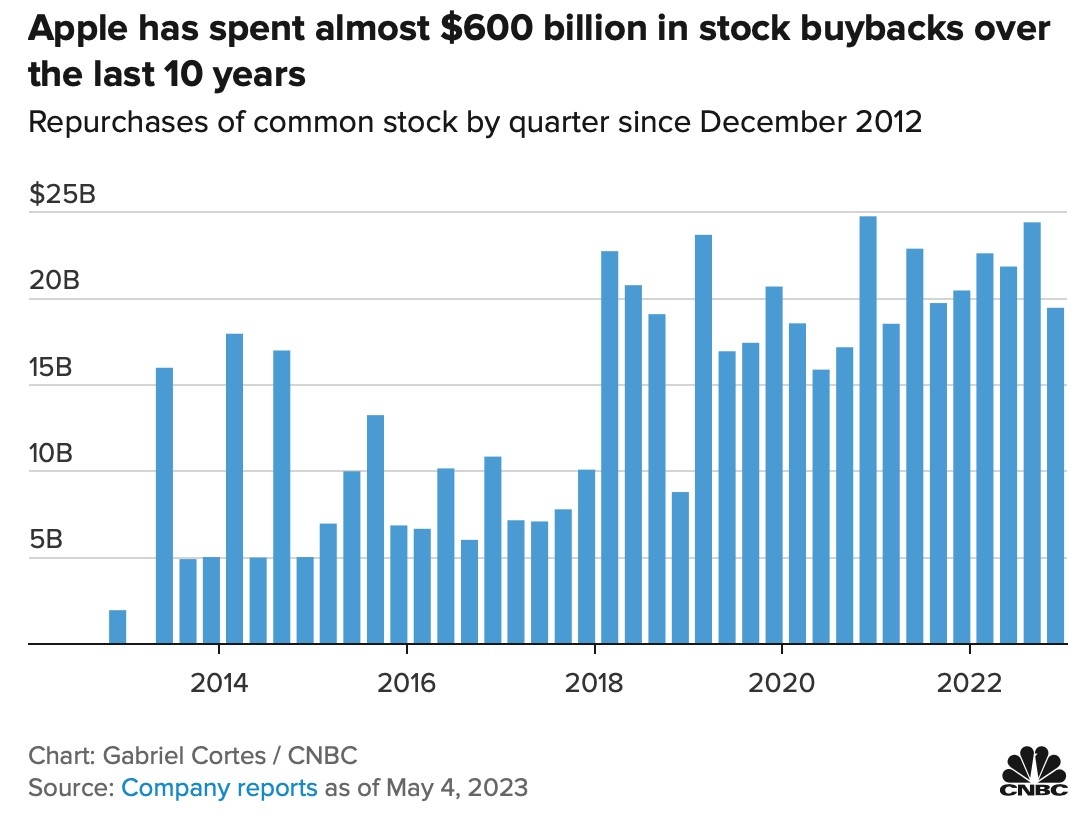

The impact of the trade talks on individual stocks has been mixed. Some companies that rely heavily on trade with China, such as Apple and Microsoft, have seen their stocks rise on the news of progress in the trade talks. However, other companies that are affected by the trade war, such as Caterpillar and Boeing, have seen their stocks decline.

Case Studies

One notable case study is the impact of the trade war on the agricultural sector. The US has imposed tariffs on Chinese imports of soybeans, which has led to a decrease in demand for American soybeans. This has had a negative impact on the stocks of agricultural companies, such as Archer-Daniels-Midland and Bunge.

Conclusion

The US-China trade talks are a complex issue with significant implications for the global economy. While there is still much uncertainty, the recent progress in the negotiations has provided some optimism. Investors should closely monitor the developments in the trade talks and their impact on the markets and stocks.

nasdaq 100 companies