Introduction: The financial world is a global village, where stock markets across different countries are interconnected like never before. The linkage between the US and Emerging Market (EM) stock markets has become a crucial aspect of global finance. This article delves into the significance of this linkage, its impact on investors, and the potential risks involved.

Understanding the Linkage

The linkage between the US and EM stock markets is primarily driven by various factors, including globalization, technological advancements, and increased cross-border investments. This interconnectedness has led to a situation where movements in one market can significantly influence the other.

Globalization: As the world becomes more interconnected, companies across borders are increasingly expanding their operations and investments in EM countries. This has led to a higher correlation between the performance of US and EM stock markets.

Technological Advancements: The advent of digital platforms and online trading has made it easier for investors to access and trade stocks in different markets. This has further strengthened the linkage between the US and EM stock markets.

Cross-Border Investments: Investors in the US are increasingly investing in EM stock markets, seeking higher returns. Conversely, EM investors are also investing in the US, diversifying their portfolios.

Impact on Investors

The linkage between the US and EM stock markets has both positive and negative impacts on investors.

Opportunities for Diversification: The linkage allows investors to diversify their portfolios by investing in different markets. This can help reduce risk and maximize returns.

Access to Growth Opportunities: EM stock markets often offer higher growth opportunities compared to mature markets like the US. The linkage enables investors to capitalize on these opportunities.

Volatility: The interconnectedness can lead to increased volatility in both markets. A decline in the US stock market can trigger a similar decline in EM stock markets, and vice versa.

Potential Risks

While the linkage offers numerous benefits, it also poses certain risks.

Economic Risks: Economic downturns in one country can quickly spread to other countries, affecting stock markets. For instance, the 2008 financial crisis originated in the US and had a significant impact on EM stock markets.

Political Risks: Political instability in one country can also affect the other. For example, tensions between the US and China have had a ripple effect on both countries' stock markets.

Currency Fluctuations: Currency fluctuations can impact the returns of investments in EM stock markets. A strong US dollar can make EM stocks less attractive to US investors.

Case Studies

The 2015 China Stock Market Crash: The rapid decline in the Chinese stock market in 2015 had a significant impact on global markets, including the US. This highlighted the interconnectedness between the US and EM stock markets.

The 2020 US-China Trade War: The trade tensions between the US and China had a negative impact on both countries' stock markets, illustrating the linkage between these markets.

Conclusion:

The linkage between the US and EM stock markets is a complex and dynamic aspect of global finance. While it offers numerous opportunities for investors, it also poses certain risks. Understanding this linkage and its implications is crucial for investors seeking to navigate the global stock market landscape.

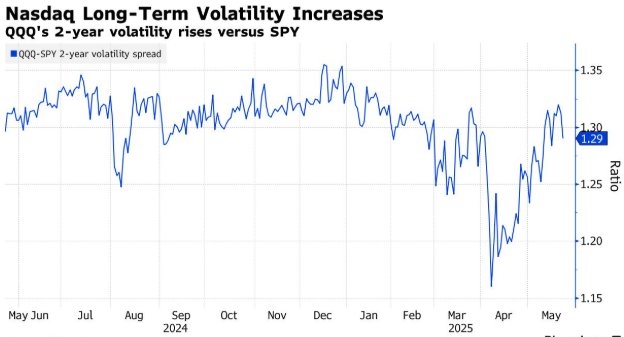

nasdaq 100 companies