Introduction

In the ever-evolving global financial landscape, the value of the US dollar plays a pivotal role in influencing investment decisions. When the dollar weakens, it can lead to a variety of economic and investment implications. This article delves into the question: Should you invest in US stocks if the dollar is weakening? We will explore the potential risks and rewards, and provide insights to help you make an informed decision.

Understanding the Weakening Dollar

A weakening dollar refers to a situation where the value of the US dollar decreases in comparison to other currencies. This can be caused by several factors, including economic indicators, geopolitical events, and market sentiment. When the dollar weakens, it can lead to inflation, higher import costs, and a boost in exports.

Risks of Investing in US Stocks During a Weakening Dollar

Rewards of Investing in US Stocks During a Weakening Dollar

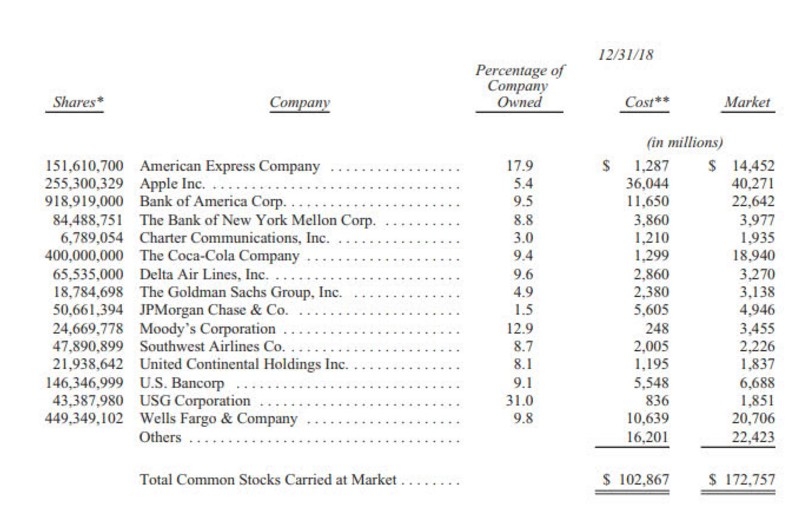

Case Study: Apple Inc.

Consider Apple Inc., a company that generates a significant portion of its revenue from international markets. In 2020, when the dollar weakened, Apple's stock price increased, driven by higher demand for its products in foreign markets. Additionally, the company's dividend payments became more valuable to investors due to the weaker dollar.

Conclusion

Investing in US stocks during a weakening dollar can be a complex decision, with both risks and rewards. While there are potential drawbacks, such as inflation and currency risk, there are also opportunities for attractive valuations and increased dividend yields. As with any investment decision, it is crucial to conduct thorough research and consider your own financial goals and risk tolerance before making a decision.

nasdaq 100 companies