The US stock market has been a beacon of growth and prosperity for decades. However, investors and market analysts often debate whether the market is overvalued. In 2019, this question was at the forefront of many discussions. This article delves into the factors that contribute to the debate on whether the US stock market was overvalued in 2019.

Historical Perspective

To understand the valuation of the US stock market in 2019, it is crucial to consider its historical context. Historically, the stock market has experienced cycles of overvaluation and undervaluation. In the late 1990s, for instance, the market was famously overvalued, leading to the dot-com bubble. However, the market corrected itself, and over the years, it has continued to grow and recover.

Market Performance in 2019

In 2019, the US stock market performed remarkably well. The S&P 500, a widely followed index of large-cap companies, posted a total return of around 29%. The NASDAQ, which tracks technology stocks, performed even better, with a return of over 35%. This performance led many to question whether the market was overvalued.

Economic Factors

Several economic factors contributed to the debate on market valuation in 2019. The US economy experienced strong growth, with unemployment rates reaching historic lows. The Federal Reserve, the country's central bank, kept interest rates low to support this growth. However, some investors worried that the low-interest-rate environment could lead to inflation and asset bubbles.

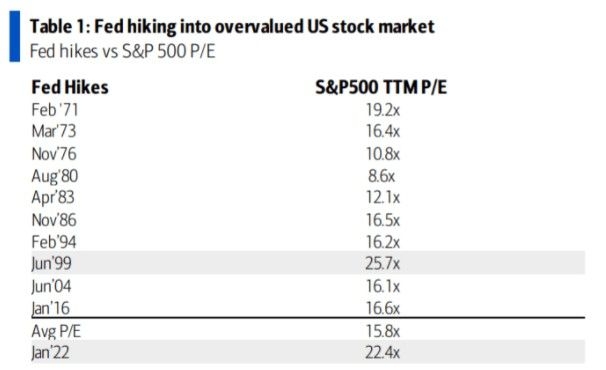

Valuation Metrics

To assess whether the stock market was overvalued, analysts often use various valuation metrics. The most common metrics include the price-to-earnings (P/E) ratio, the price-to-book (P/B) ratio, and the cyclically adjusted price-to-earnings (CAPE) ratio. In 2019, the P/E ratio for the S&P 500 was around 19, which was higher than the long-term average of 16. This led some to conclude that the market was overvalued.

Market Trends and Sentiment

Another important factor in the debate was market trends and sentiment. In 2019, the stock market saw a significant increase in the popularity of "growth stocks," which are companies with high revenue growth and low profit margins. This trend, combined with the low-interest-rate environment, led to a rise in stock prices. However, some investors worried that this trend could lead to market volatility.

Case Studies

To further understand the debate, let's look at a couple of case studies. Amazon, a prominent growth stock, saw its share price skyrocket in 2019, leading some to question whether it was overvalued. Similarly, Tesla, another growth stock, experienced significant growth in its stock price, sparking discussions about market valuation.

Conclusion

In 2019, the debate on whether the US stock market was overvalued was a topic of much discussion. While the market performed well and experienced strong growth, some investors and analysts worried about its valuation. Various economic factors, market trends, and sentiment played a role in this debate. Whether the market was overvalued or not, it is essential for investors to stay informed and make well-informed decisions.

nasdaq 100 companies