The US stock market has always been a beacon of economic activity and a key indicator of the nation's financial health. As of the latest data, let's delve into the current state of the market and what it means for investors and the economy at large.

Current Market Overview

As of the time of writing, the US stock market is showing a mix of strength and uncertainty. Key indices like the S&P 500 and the Dow Jones Industrial Average have been fluctuating, reflecting both the optimism and the anxieties in the market.

Factors Influencing the Market

Economic Indicators: The Federal Reserve's monetary policy decisions and economic indicators such as GDP, unemployment rates, and inflation are critical factors. The Fed's recent moves to raise interest rates have had a significant impact on the market.

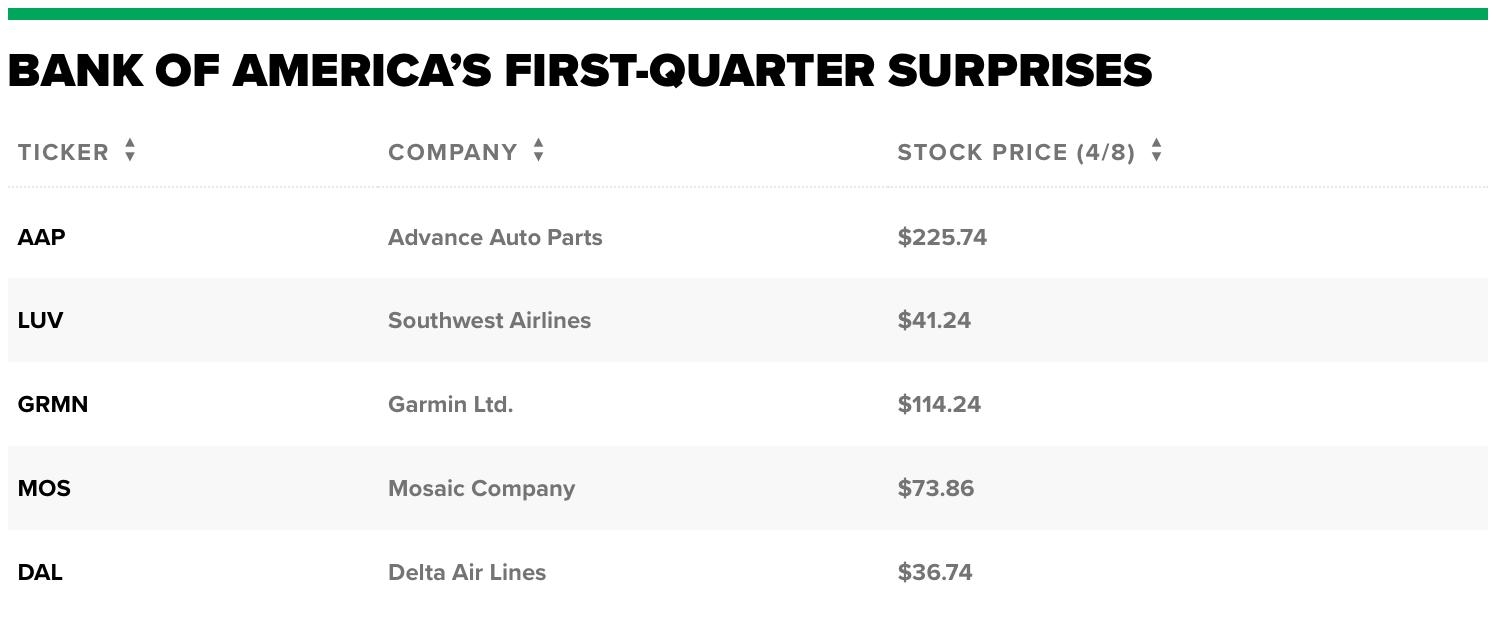

Corporate Earnings: The earnings reports of major companies are a major driver of stock prices. Companies that exceed expectations tend to see their stock prices rise, while those that miss expectations may see their prices fall.

Global Events: International events, such as trade tensions, geopolitical conflicts, and changes in global economic policies, can also have a significant impact on the US stock market.

Recent Developments

Case Study: Tesla, Inc.

Tesla, Inc. is a prime example of how the stock market can be volatile. In early 2021, the company's stock price soared to new highs, driven by strong sales and expectations of future growth. However, the stock has since seen significant volatility, reflecting concerns about the company's profitability and regulatory challenges.

What does this Mean for Investors?

Conclusion

The US stock market is currently showing a mix of strengths and uncertainties. While there are risks, there are also opportunities for investors who stay informed and maintain a long-term perspective.

nasdaq 100 companies