Front Matter:

In today's fast-paced financial world, staying updated with the US stock market is crucial for investors and traders alike. This daily update provides a snapshot of the latest developments, insights, and trends in the US stock market, ensuring you are well-informed to make informed decisions.

Market Overview:

The US stock market opened on a volatile note yesterday, with the S&P 500 and the Dow Jones Industrial Average experiencing significant ups and downs. The market was primarily influenced by economic data releases and geopolitical tensions.

Key Developments:

- Economic Data: The US Bureau of Labor Statistics reported that the unemployment rate remained unchanged at 3.6% in April, while the number of jobs added was lower than expected. This data raised concerns about the strength of the US economy.

- Corporate Earnings: Several major companies reported their first-quarter earnings, with mixed results. While some companies exceeded expectations, others missed them. The market's reaction was largely driven by the guidance provided by these companies.

- Geopolitical Tensions: The ongoing tensions between the US and China continued to weigh on the market. Investors are closely monitoring the situation and its potential impact on global trade and economic growth.

Sector Performance:

- Technology Sector: The technology sector remained under pressure, with major tech giants like Apple and Microsoft experiencing declines. This was primarily due to concerns about slowing growth and increased competition.

- Energy Sector: The energy sector saw a significant rally, driven by rising oil prices and strong earnings reports from major oil companies.

- Healthcare Sector: The healthcare sector performed well, with biotech companies leading the charge. This was driven by positive clinical trial results and increased interest in the sector.

Stock Movements:

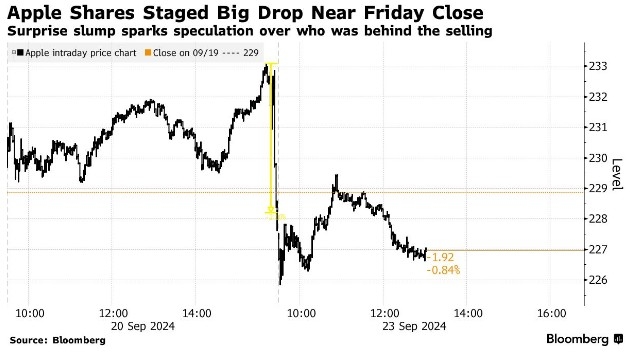

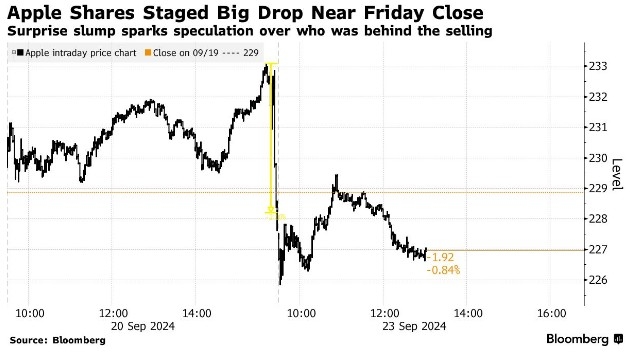

- Apple Inc. (AAPL): Shares of Apple Inc. fell after the company reported lower-than-expected revenue and profit during its first fiscal quarter. The stock is now trading below its 52-week high.

- Exxon Mobil Corp. (XOM): Shares of Exxon Mobil Corp. surged after the company reported strong earnings and increased its dividend. The stock is now trading near its 52-week high.

- Tesla Inc. (TSLA): Shares of Tesla Inc. remained volatile, with the stock experiencing significant ups and downs. The company's recent announcement of a price cut for its Model S and Model X did not seem to have a lasting impact on the stock.

Insights:

- Market Volatility: The recent volatility in the stock market is a reminder of the importance of diversification and risk management.

- Economic Data: Economic data releases continue to play a crucial role in shaping market sentiment.

- Geopolitical Tensions: The ongoing geopolitical tensions remain a significant risk factor for the market.

Conclusion:

In conclusion, the US stock market experienced a mix of volatility and stability yesterday. As investors, it is essential to stay informed about the latest developments and trends in the market to make informed decisions. Stay tuned for our next daily update for more insights into the US stock market.