In the ever-evolving financial landscape, the United States stock market is a key indicator of economic health and investor sentiment. One crucial factor that significantly influences the stock market is the interest rate set by the Federal Reserve. This article delves into the intricacies of US stock interest rates, their impact on the market, and how investors can navigate these changes.

The Federal Reserve and Interest Rates

The Federal Reserve, often referred to as the Fed, is the central banking system of the United States. One of its primary responsibilities is to set the interest rates, which in turn affect various aspects of the economy, including the stock market. The interest rate is the cost of borrowing money, and when it rises, it becomes more expensive for companies to finance their operations and expansions. Conversely, when interest rates fall, borrowing becomes cheaper, potentially boosting corporate earnings and stock prices.

Impact of Rising Interest Rates on the Stock Market

When the Fed raises interest rates, it typically aims to control inflation and cool down an overheated economy. However, this can have a negative impact on the stock market. Here's how:

Impact of Falling Interest Rates on the Stock Market

Conversely, when the Fed lowers interest rates, it aims to stimulate economic growth. This can have a positive impact on the stock market:

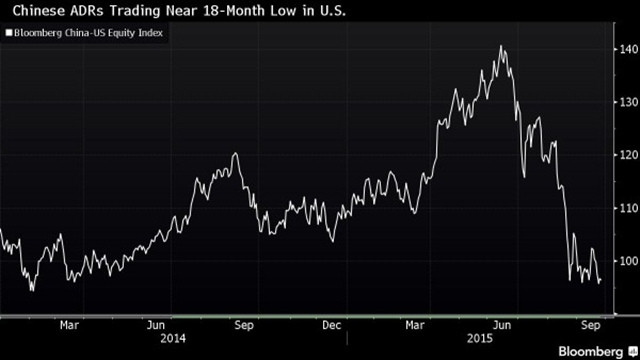

Case Study: The 2015 Rate Hike

One notable example of the impact of interest rate changes on the stock market is the 2015 rate hike by the Federal Reserve. The Fed raised interest rates for the first time in nearly a decade, leading to a sell-off in the stock market. However, over time, the market recovered, and stock prices began to rise again. This case highlights the short-term volatility that can occur due to interest rate changes, but also the long-term resilience of the stock market.

Conclusion

Understanding the relationship between US stock interest rates and the stock market is crucial for investors looking to navigate the financial landscape. While rising interest rates can lead to short-term volatility, they are often a sign of a healthy economy. Conversely, falling interest rates can indicate a weakening economy, but they can also lead to higher stock prices. By staying informed and adapting their investment strategies accordingly, investors can better position themselves for success in the stock market.

nasdaq composite