Stay Ahead of the Curve with the Latest US Stock Market News

In today's fast-paced financial world, staying updated with the latest US stock market news is crucial for investors and traders alike. Whether you're a seasoned pro or just starting out, understanding the key developments and market insights can significantly impact your investment decisions. In this article, we'll delve into some of the latest news and analysis, covering everything from major stock movements to economic indicators.

1. Major Stock Movements

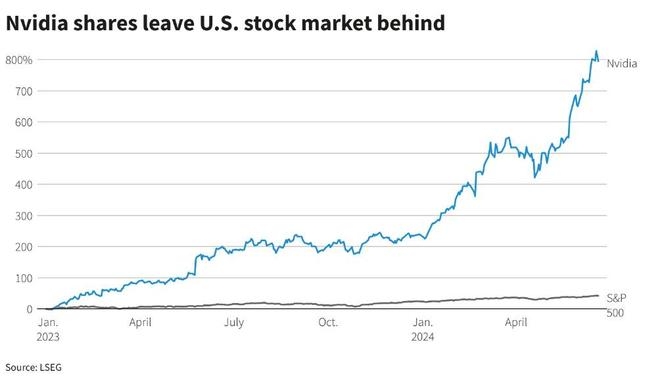

One of the most talked-about topics in the US stock market is the movement of major indices like the S&P 500 and the Dow Jones Industrial Average. These indices provide a snapshot of the overall market's performance. Lately, we've seen some interesting trends.

The S&P 500 has been experiencing a volatile period, with sharp ups and downs. While some investors are taking advantage of these fluctuations, others are cautious due to the uncertainty surrounding global economic conditions.

Case Study: Last month, the S&P 500 experienced a sharp drop, causing panic among investors. However, as the market stabilized, those who remained patient and stayed focused on long-term investment goals were able to capitalize on the subsequent rally.

The Dow Jones Industrial Average has also been under scrutiny, with investors closely watching the performance of its 30 constituent companies. The index has seen both gains and losses, reflecting the diverse nature of the companies it represents.

2. Economic Indicators

Economic indicators play a vital role in shaping the US stock market. From GDP growth to unemployment rates, these indicators provide valuable insights into the overall health of the economy.

GDP Growth has been a key driver of market sentiment, with investors closely monitoring the latest data. The recent GDP report showed a strong expansion, boosting investor confidence.

Unemployment Rates have also been a significant factor, with the latest figures showing a decline in joblessness. This trend has been seen as a positive sign for the economy and the stock market.

3. Sector Performance

Sector performance is another critical aspect of the US stock market. Different sectors respond to economic conditions and market trends in different ways.

Technology Stocks have been leading the charge, with companies like Apple and Microsoft posting impressive gains. However, investors should be aware of the risks associated with this sector, as it can be highly volatile.

Financial Stocks have also been performing well, with banks and insurance companies reporting strong earnings. This trend has been attributed to the low-interest-rate environment and increased demand for financial services.

4. Impact of Global Events

Global events can have a significant impact on the US stock market. From geopolitical tensions to trade disputes, these events can cause market volatility and uncertainty.

Geopolitical Tensions between major economies have been a source of concern for investors. However, the market has shown resilience, with many investors choosing to focus on long-term investment strategies.

Trade Disputes have also been a key factor, with investors closely watching the latest developments between the US and China. While these disputes have caused some short-term volatility, the market has generally remained stable.

5. Conclusion

Staying informed about the latest US stock market news is essential for making well-informed investment decisions. By understanding the key developments, economic indicators, sector performance, and global events, investors can navigate the market with confidence. As always, it's crucial to consult with a financial advisor to tailor your investment strategy to your individual goals and risk tolerance.

nasdaq composite