The landscape of the US stock market is ever-evolving, and for investors looking to capitalize on the potential of large-cap stocks, understanding the outlook for 2025 is crucial. This article delves into the key factors that will shape the future of large-cap stocks in the United States, providing investors with valuable insights to make informed decisions.

Economic Factors to Consider

One of the primary drivers of large-cap stock performance is the overall economic environment. As we look ahead to 2025, several economic factors are poised to impact the market:

- Inflation: The Federal Reserve's monetary policy will play a pivotal role in determining inflation levels. A sustained period of low inflation is generally favorable for large-cap stocks, as it allows companies to maintain profitability and reinvest in growth.

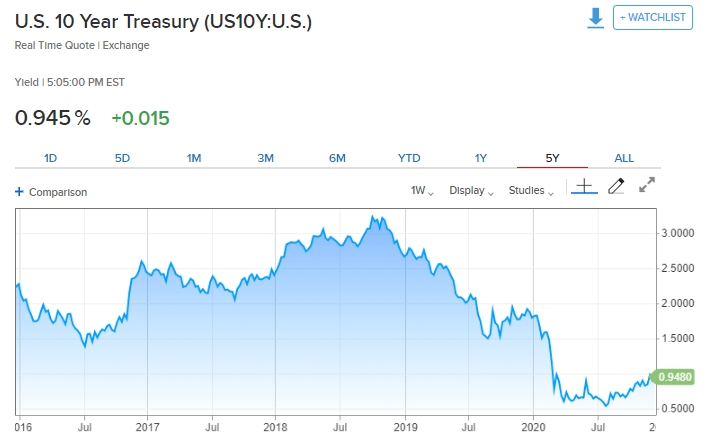

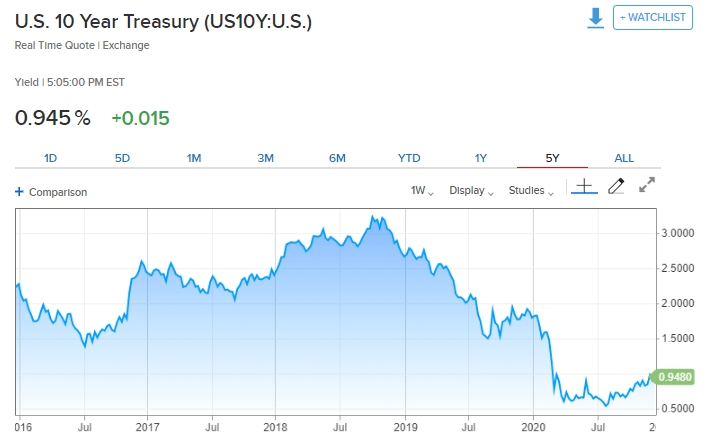

- Interest Rates: The Federal Reserve's interest rate decisions will also have a significant impact. Historically, higher interest rates have been negative for stocks, but with the right economic backdrop, large-cap companies with strong balance sheets can weather the storm.

- GDP Growth: The rate of economic growth in the United States will be a key indicator of market performance. A robust GDP growth rate suggests a healthy economy, which is generally positive for large-cap stocks.

Sector Trends to Watch

In addition to economic factors, sector trends will play a crucial role in shaping the outlook for large-cap stocks in 2025. Here are some key sectors to watch:

- Technology: The technology sector has been a major driver of large-cap stock performance in recent years. As we look ahead to 2025, continued innovation and growth in areas such as artificial intelligence, cloud computing, and 5G will likely support strong performance in this sector.

- Healthcare: The healthcare sector is another area with significant potential for growth. As the population ages and healthcare needs increase, companies in this sector are well-positioned to benefit from rising demand for medical services and products.

- Consumer Discretionary: The consumer discretionary sector, which includes companies in industries such as retail, leisure, and automotive, may experience a rebound in 2025 as the economy strengthens and consumer confidence improves.

Case Studies: Large-Cap Stock Performance

To illustrate the potential of large-cap stocks in 2025, let's consider a few case studies:

- Apple Inc. (AAPL): As a leader in the technology sector, Apple has demonstrated strong resilience and growth over the years. With a robust product lineup and a focus on innovation, Apple is well-positioned to continue its upward trajectory in 2025.

- Johnson & Johnson (JNJ): As a diversified healthcare company, Johnson & Johnson has a strong track record of growth and stability. With a focus on healthcare innovation and a diverse portfolio of products, JNJ is likely to remain a solid investment in 2025.

- Walmart Inc. (WMT): As a dominant player in the consumer discretionary sector, Walmart has shown its ability to adapt to changing consumer preferences and market conditions. With a strong e-commerce presence and a focus on value, WMT is poised for continued growth in 2025.

Conclusion

As we look ahead to 2025, the outlook for US large-cap stocks is promising, driven by favorable economic conditions, sector trends, and strong company fundamentals. By understanding the key factors that will shape the market and conducting thorough research, investors can identify promising opportunities in the large-cap space.