In the ever-evolving world of finance, the term "Odong time" has recently gained traction, particularly among investors and market enthusiasts. But what does it mean, and how does it relate to the US stock market? This article delves into this intriguing concept, offering insights into the dynamics of the US stock market and how investors can leverage this knowledge to make informed decisions.

What is Odong Time?

The term "Odong time" refers to a period when the US stock market experiences a significant upswing, often attributed to various factors such as economic growth, corporate earnings, and geopolitical events. During this time, investors often witness a surge in stock prices, leading to increased optimism and investment activity.

Understanding the US Stock Market Dynamics

The US stock market is one of the most robust and liquid markets in the world, attracting investors from across the globe. To understand the dynamics of the US stock market, it's essential to consider the following factors:

Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation play a crucial role in shaping the stock market. A strong economy often translates to higher corporate earnings and, subsequently, higher stock prices.

Corporate Earnings: The performance of individual companies significantly impacts the stock market. Positive earnings reports can lead to increased investor confidence and higher stock prices, while negative reports can have the opposite effect.

Geopolitical Events: Geopolitical events, such as elections, trade wars, and international conflicts, can cause volatility in the stock market. Investors often react to such events by adjusting their portfolios accordingly.

Technological Advancements: Technological advancements can revolutionize industries and create new opportunities for investment. Companies at the forefront of technological innovation often see significant growth in their stock prices.

Case Studies: Leveraging Odong Time

To illustrate the impact of Odong time on the US stock market, let's consider a few case studies:

Tech Stocks in the 1990s: The late 1990s marked the rise of the internet, leading to a surge in tech stocks. Companies like Microsoft, Apple, and Google experienced significant growth during this period, benefiting investors who identified the potential of these emerging technologies.

Post-COVID-19 Recovery: The COVID-19 pandemic initially caused a significant downturn in the stock market. However, as the economy began to recover, investors witnessed a strong upswing, particularly in sectors like technology and healthcare.

Election Year Volatility: Election years often bring uncertainty to the stock market. However, investors who closely monitored the market dynamics and adjusted their portfolios accordingly could capitalize on the volatility.

Conclusion

Understanding the dynamics of the US stock market, particularly during Odong time, is crucial for investors looking to make informed decisions. By keeping a close eye on economic indicators, corporate earnings, geopolitical events, and technological advancements, investors can navigate the complexities of the stock market and potentially capitalize on opportunities that arise during Odong time.

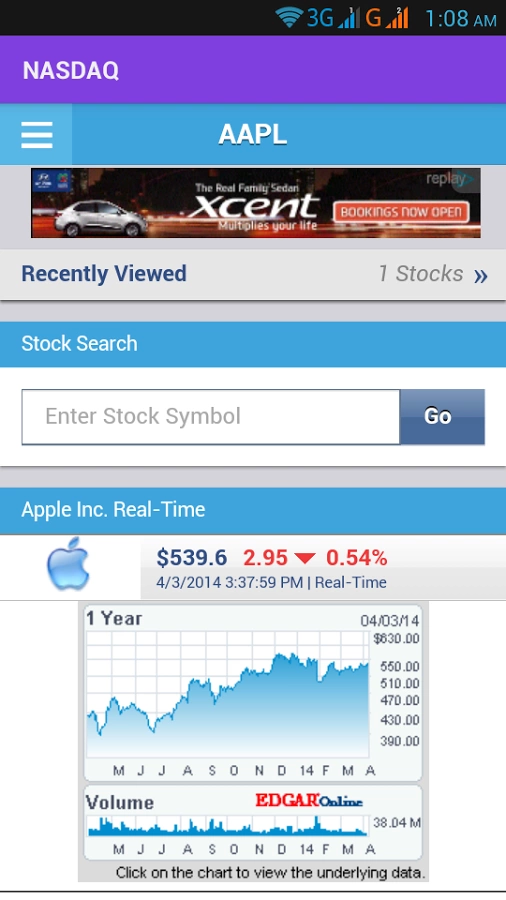

nasdaq composite