Are you looking to trade stocks in the US but unsure where to start? The stock market can be a daunting place for beginners, but with the right knowledge and strategy, you can maximize your investment potential. In this article, we'll explore the basics of trading stocks in the US, including the best platforms, tips for success, and common mistakes to avoid.

Understanding the Stock Market

Before diving into trading stocks, it's essential to understand the stock market itself. The stock market is a place where shares of publicly-traded companies are bought and sold. When you buy a stock, you're essentially purchasing a small piece of that company.

Choosing a Brokerage Platform

The first step in trading stocks is to choose a brokerage platform. There are many options available, each with its own set of features and fees. Some popular brokerage platforms include:

Creating a Trading Plan

Once you've chosen a brokerage platform, the next step is to create a trading plan. This plan should include your investment goals, risk tolerance, and trading strategy. Some key elements of a trading plan include:

Tips for Success

To increase your chances of success in the stock market, consider the following tips:

Common Mistakes to Avoid

Avoiding common mistakes can help you avoid costly errors in your trading journey. Some common mistakes include:

Case Study: Investing in Technology Stocks

Let's say you're interested in investing in technology stocks. One company you're considering is Apple Inc. (AAPL). Before investing, you should research the company's financials, its market position, and its growth potential. You should also consider the risks associated with the technology industry, such as rapid changes in technology and competition.

After conducting your research, you decide to invest in Apple Inc. with a long-term perspective. Over the next few years, the stock price of Apple Inc. increases significantly, allowing you to realize a substantial return on your investment.

By following these guidelines and staying informed, you can trade stocks in the US and potentially achieve your investment goals. Remember, the stock market requires patience, discipline, and a willingness to learn.

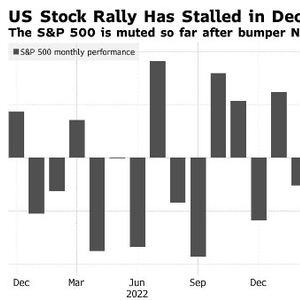

nasdaq composite