In the dynamic world of technology, VMware (VMC) has emerged as a leading player, captivating the attention of investors and market enthusiasts alike. This article delves into the full description of VMware stock, exploring its market performance, financial health, and future prospects. Whether you are a seasoned investor or a novice, understanding the nuances of VMware's stock is crucial for making informed decisions.

VMware's Market Performance

VMware, founded in 1998, has grown to become a global leader in virtualization and cloud infrastructure. Over the years, the company has showcased a robust market performance, with its stock price reflecting its market dominance. Since its IPO in 2007, VMware has seen significant growth, making it a preferred investment for many.

One of the key factors contributing to VMware's strong market performance is its innovative products and services. The company's virtualization platform, vSphere, has become the industry standard, enabling businesses to optimize their IT infrastructure. Additionally, VMware's cloud offerings, such as vCloud Air, have allowed companies to seamlessly migrate their operations to the cloud, further solidifying its market position.

Financial Health and Dividends

Analyzing VMware's financial health is crucial for understanding its stock's potential. The company has demonstrated a consistent revenue growth, with its quarterly reports showcasing robust financial performance. In the past few years, VMware has reported strong earnings, driven by its high demand for virtualization and cloud services.

Moreover, VMware has been a shareholder-friendly company, consistently increasing its dividend payouts. The company's dividend yield has made it an attractive investment for income-oriented investors. As of now, VMware offers a dividend yield of around 1.7%, which is a testament to its financial stability and commitment to rewarding shareholders.

Future Prospects

Looking ahead, VMware's future prospects appear promising. The company is continuously evolving its product portfolio to cater to the ever-changing technology landscape. VMware's strategic investments in areas such as software-defined data centers and hybrid cloud solutions are expected to drive future growth.

Furthermore, the increasing demand for cloud services has created a favorable environment for VMware. As more businesses embrace digital transformation, the need for virtualization and cloud infrastructure is expected to rise. VMware, being a market leader in these areas, is well-positioned to capitalize on this trend.

One of the key factors contributing to VMware's future growth is its strong partnerships with industry leaders. The company has formed strategic alliances with major players, such as Amazon Web Services (AWS) and Microsoft Azure, which have further extended its reach and market influence.

Case Studies

To better understand VMware's market performance, let's take a look at some case studies:

VMware's Acquisition of AirWatch: In 2014, VMware acquired AirWatch, a leading mobile device management (MDM) provider. This acquisition allowed VMware to offer a comprehensive mobile security solution, enhancing its value proposition and driving revenue growth.

VMware's Partnership with AWS: In 2016, VMware formed a strategic partnership with AWS, enabling customers to run VMware workloads on AWS. This collaboration has helped VMware expand its market reach and generate additional revenue streams.

Conclusion

In conclusion, VMware has demonstrated a strong market performance, driven by its innovative products, financial stability, and commitment to shareholder value. With a promising future ahead, VMware remains an attractive investment opportunity for investors seeking exposure to the dynamic technology sector. As always, it is essential to conduct thorough research and consult with financial advisors before making investment decisions.

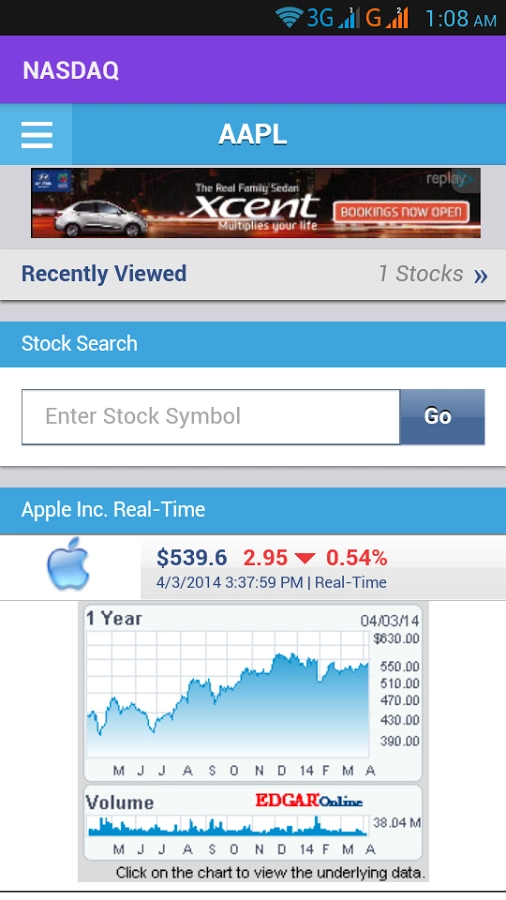

nasdaq composite