Are you an international student looking to expand your investment portfolio? If so, you might be wondering whether you can invest in US stocks. The answer is a resounding yes! Investing in US stocks can be a lucrative opportunity, but it's important to understand the process and regulations. In this article, we'll explore how international students can invest in US stocks, the benefits, and the steps involved.

Understanding the Process

Firstly, it's crucial to note that international students can invest in US stocks, but there are specific requirements and procedures to follow. Here's a brief overview of the process:

- Open a Brokerage Account: International students need to open a brokerage account to buy US stocks. This account will allow you to trade stocks, bonds, and other financial instruments.

- Get a Tax Identification Number (TIN): Since you're not a US citizen, you'll need a Tax Identification Number (TIN) to open a brokerage account. This can be obtained through the IRS website.

- Understand the Risks: Investing in stocks always involves risks. It's important to research and understand the risks associated with investing in US stocks.

- Start Small: As a beginner, it's advisable to start with a small investment and gradually increase your investment as you gain more experience and confidence.

Benefits of Investing in US Stocks

Investing in US stocks offers several benefits, especially for international students:

- Potential for High Returns: The US stock market has historically provided higher returns compared to other markets.

- Diversification: Investing in US stocks can help diversify your portfolio and reduce the risk of loss.

- Access to World-Class Companies: The US stock market is home to some of the world's most successful and innovative companies.

- Growth Opportunities: The US economy is one of the largest and most stable in the world, providing numerous growth opportunities.

Steps to Invest in US Stocks

Here's a step-by-step guide to help you get started:

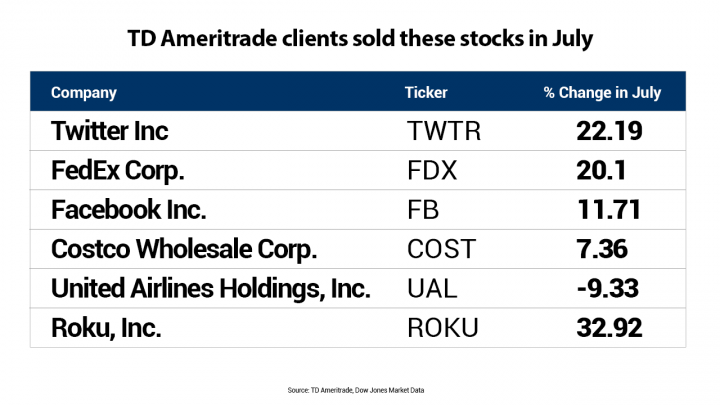

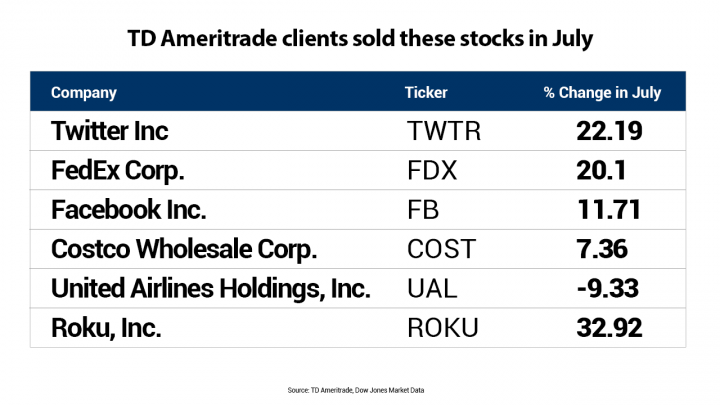

- Research and Choose a Brokerage: Research various brokerage firms and choose one that suits your needs. Some popular options for international students include TD Ameritrade, E*TRADE, and Charles Schwab.

- Open a Brokerage Account: Fill out the required forms and submit the necessary documents to open a brokerage account.

- Fund Your Account: Transfer funds from your bank account to your brokerage account.

- Research and Select Stocks: Conduct thorough research to identify stocks that align with your investment goals and risk tolerance.

- Place an Order: Once you've identified the stocks you want to invest in, place an order through your brokerage account.

Case Study: Investing in Apple (AAPL)

Let's consider a hypothetical case study to illustrate how international students can invest in US stocks. Suppose you're interested in investing in Apple Inc. (AAPL), one of the world's largest and most valuable companies.

- Research: Conduct thorough research on Apple's financials, market position, and growth prospects.

- Open a Brokerage Account: Open a brokerage account and fund it with the necessary amount.

- Place an Order: Place an order to buy Apple stocks through your brokerage account.

- Monitor Your Investment: Keep track of your investment and adjust your strategy as needed.

In conclusion, international students can invest in US stocks, and it can be a valuable opportunity for financial growth. By understanding the process, benefits, and risks, you can make informed decisions and start building a strong investment portfolio.