In the dynamic world of finance, US stock futures play a pivotal role for investors looking to gain exposure to the stock market without owning the actual stocks. This article delves into the intricacies of US stock futures, providing you with a comprehensive understanding of how they work, their benefits, and their potential risks.

What are US Stock Futures?

US stock futures are financial contracts that allow investors to buy or sell a specific number of shares of a particular stock at a predetermined price on a future date. These contracts are traded on various exchanges, including the Chicago Mercantile Exchange (CME) and the Chicago Board of Trade (CBOT).

Key Features of US Stock Futures

Leverage: One of the primary advantages of stock futures is leverage. Investors can control a larger position with a smaller amount of capital, which can amplify returns but also increase risk.

Hedging: Stock futures can be used as a hedging tool to protect against potential losses in the underlying stock. This is particularly useful for investors who already own shares of a particular company and want to mitigate the risk of a market downturn.

Speculation: Investors can also use stock futures to speculate on the future price movements of a stock, aiming to profit from price fluctuations.

Benefits of Investing in US Stock Futures

Liquidity: US stock futures are highly liquid, which means they can be bought and sold quickly without significantly affecting the market price.

Access to a Wide Range of Stocks: Investors can gain exposure to a wide range of stocks through futures contracts, including those that may not be accessible through traditional stock trading.

Risk Management: By using stock futures, investors can manage their risk more effectively, especially when dealing with volatile markets.

Understanding the Risks

While US stock futures offer numerous benefits, they also come with inherent risks:

Leverage Risks: The high leverage associated with stock futures can amplify both gains and losses. Investors must be cautious and manage their positions accordingly.

Market Volatility: Stock futures are subject to market volatility, which can lead to rapid price movements and potential losses.

Regulatory Changes: Changes in regulations can impact the trading of stock futures, so it's important to stay informed about any updates.

Case Study: Apple Stock Futures

Consider the case of Apple Inc. (AAPL). An investor who believes that Apple's stock price will rise in the near future can buy Apple stock futures. If the stock price does indeed increase, the investor can sell the futures at a higher price, realizing a profit. Conversely, if the stock price falls, the investor could face a significant loss.

Conclusion

US stock futures offer a unique way for investors to gain exposure to the stock market. By understanding how they work, their benefits, and the associated risks, investors can make informed decisions and potentially enhance their investment strategies. Always remember to conduct thorough research and consider seeking advice from a financial professional before engaging in futures trading.

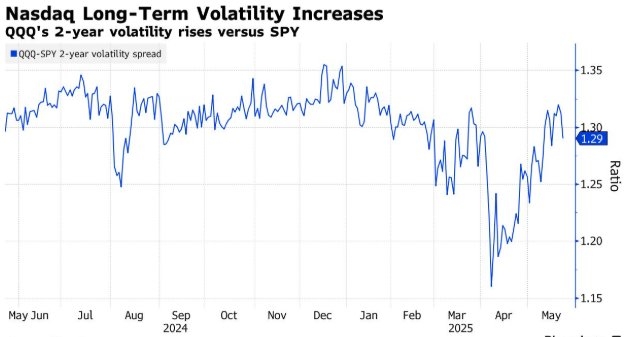

index nasdaq 100