In the ever-evolving landscape of the stock market, certain companies often fly under the radar, their potential unrecognized. However, the 2024 US political environment and election are poised to bring about significant changes that could benefit these undervalued stocks. This article delves into how political shifts can impact the market and highlights some potential winners in this dynamic scenario.

The Impact of the Political Environment on Stock Market Dynamics

The political environment plays a crucial role in shaping economic policies and regulatory frameworks, which, in turn, affect the stock market. The 2024 US election is no exception, with its outcomes likely to influence various sectors differently.

Key Political Factors to Watch

Tax Policies: Tax rates and incentives are pivotal in determining the profitability of companies. A shift in tax policies could significantly impact undervalued stocks, especially those in sectors like technology, energy, and healthcare.

Regulatory Changes: Regulatory frameworks can either boost or hinder the growth of certain industries. Companies in industries such as telecommunications, banking, and pharmaceuticals could see substantial changes post-election.

Trade Policies: Trade agreements and tariffs can have a profound impact on international businesses. The 2024 election could lead to shifts in trade policies, affecting companies with global operations.

Undervalued Stocks to Watch

Technology Sector: Companies like Intel and Qualcomm are often undervalued due to market skepticism. However, with potential changes in tax policies and regulatory frameworks, these companies could see significant growth.

Energy Sector: ExxonMobil and Chevron are two energy giants that have been undervalued for years. A shift in tax policies and regulatory frameworks could lead to increased profitability and stock value.

Healthcare Sector: Johnson & Johnson and Merck are two healthcare giants that have been undervalued. Changes in healthcare policies could lead to increased demand for their products and services.

Case Study: Intel's Potential Rise

Consider Intel, a leading technology company. Historically undervalued, Intel's stock has struggled to keep pace with its peers. However, with potential changes in tax policies and regulatory frameworks, Intel could see a significant rise in its stock value.

Conclusion

The 2024 US political environment and election present a unique opportunity for undervalued stocks to benefit. By understanding the key political factors and identifying potential winners, investors can capitalize on this dynamic scenario. As always, it is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

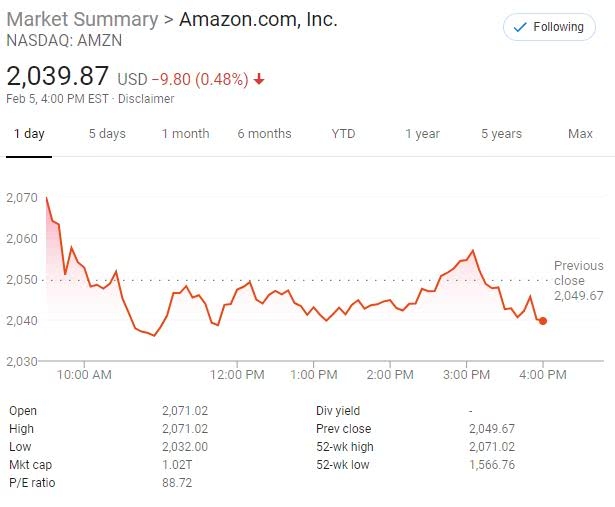

index nasdaq 100