In the complex world of financial accounting, preferred stock plays a significant role for companies looking to raise capital. Understanding how preferred stock is accounted for under the U.S. Generally Accepted Accounting Principles (GAAP) is crucial for investors, analysts, and financial professionals. This article delves into the intricacies of accounting for preferred stock, highlighting key concepts and providing real-world examples to enhance comprehension.

What is Preferred Stock?

Preferred stock is a type of equity security that represents ownership in a company but typically carries a higher claim on assets and earnings than common stock. Preferred shareholders have a higher priority in receiving dividends and liquidation proceeds compared to common shareholders. This makes preferred stock an attractive investment for investors seeking stable income.

Accounting for Preferred Stock Under US GAAP

Under US GAAP, preferred stock is accounted for in several ways, depending on the terms of the stock agreement. Here are the primary methods:

1. Straight-Line Amortization of Discount or Premium

When a preferred stock is issued at a price below its par value (a discount), the discount is amortized over the life of the stock. Similarly, if the stock is issued at a price above its par value (a premium), the premium is amortized in the same manner. This method ensures that the total dividend expense over the life of the stock reflects the actual cost of the capital raised.

2. Dividend in Kind

In some cases, preferred stock dividends may be paid in additional shares of stock rather than in cash. This is known as a dividend in kind. Under US GAAP, the dividend in kind is accounted for by increasing the par value of the preferred stock and reducing the retained earnings.

3. Dividend Arrears

If a preferred stock dividend is not paid when due, it is considered a dividend in arrears. The accrued dividends are recorded as a liability on the company’s balance sheet until the dividend is paid. This ensures that the financial statements accurately reflect the company’s obligations.

Real-World Example:

Consider Company XYZ, which issued

Conclusion

Accounting for preferred stock under US GAAP is a complex process that requires a thorough understanding of the terms of the stock agreement. By following the appropriate accounting methods and ensuring accurate reporting, companies can provide investors with a clear picture of their financial position and performance. For investors and financial professionals, staying informed about these accounting principles is essential for making informed decisions.

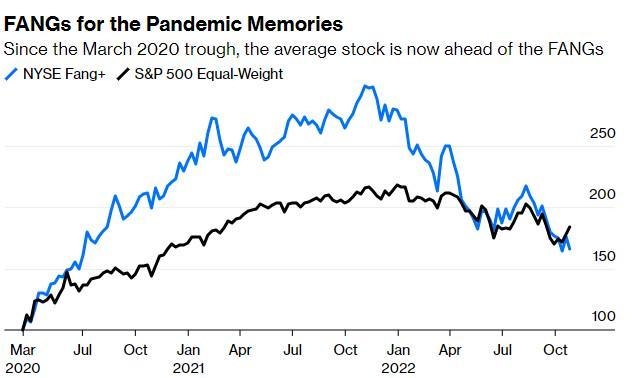

index nasdaq 100