In the fast-paced world of the US stock market, investors are constantly seeking opportunities to capitalize on market trends. One of the most intriguing phenomena observed is the transition from bids to sales. This article delves into the reasons behind this shift, the implications for investors, and provides a comprehensive analysis of the dynamics at play.

Understanding the Transition

The term "us stock market bids turned sales" refers to the situation where investors initially place bids on a stock, expecting its value to rise, but later decide to sell the stock instead. This shift can occur due to various factors, including market sentiment, economic indicators, and company-specific news.

Market Sentiment and Economic Indicators

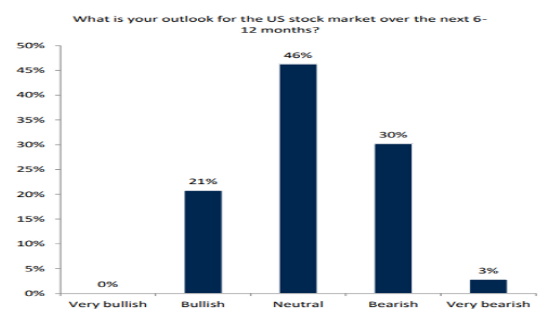

One of the primary reasons for bids turning into sales is market sentiment. When the overall market sentiment turns bearish, investors may become wary of holding onto stocks, leading to a surge in selling. Additionally, economic indicators such as GDP growth, unemployment rates, and inflation can influence investor decisions. For instance, if the GDP growth rate slows down, investors may become concerned about the future of the economy and opt to sell their stocks.

Company-Specific News

Company-specific news can also trigger a shift from bids to sales. Negative news, such as a product recall, financial scandal, or earnings shortfall, can erode investor confidence and lead to a sell-off. Conversely, positive news, such as a successful product launch or strong earnings report, can boost investor sentiment and lead to increased buying.

Case Study: Apple Inc.

A notable example of bids turning into sales is the case of Apple Inc. In early 2020, Apple's stock experienced a significant surge due to strong earnings reports and positive market sentiment. However, as the COVID-19 pandemic unfolded, investor sentiment turned bearish, and Apple's stock began to decline. Many investors who had initially placed bids on the stock decided to sell, leading to a sharp drop in its value.

Strategies for Investors

Understanding the factors that drive bids turning into sales can help investors make informed decisions. Here are some strategies to consider:

Conclusion

The transition from bids to sales in the US stock market is a complex phenomenon influenced by various factors. By understanding the underlying dynamics and adopting appropriate strategies, investors can navigate this volatile market more effectively. Remember, staying informed and diversified is key to long-term success in the stock market.

index nasdaq 100