Introduction: Investing in the United States is a dream for many international investors. With a robust economy and numerous successful companies, the US stock market presents a lucrative opportunity. However, one common question that arises is whether foreigners are allowed to buy US stocks. In this article, we will explore the regulations surrounding this topic and provide you with valuable insights to help you make informed decisions.

Understanding the Basics: Foreigners are indeed allowed to buy US stocks. The United States has no specific law that prohibits non-US citizens from investing in its stock market. However, certain regulations and restrictions apply to ensure compliance with tax and financial regulations.

Types of Accounts: To invest in US stocks, foreigners need to open a brokerage account. There are several types of accounts available:

Regular Brokerage Account: This is the most common type of account used by individual investors. It allows you to buy and sell stocks, bonds, and other securities.

Individual Retirement Account (IRA): An IRA is a tax-advantaged account that can be used for retirement savings. Both residents and non-residents can open an IRA, but there are certain eligibility requirements.

Roth IRA: Similar to a regular IRA, a Roth IRA allows you to contribute after-tax dollars and withdraw them tax-free in retirement. However, certain income limits may apply.

Foreign Portfolio Investor (FPI) Account: This account is specifically designed for non-US residents who want to invest in the US stock market. It requires additional documentation and reporting, but it provides access to a wider range of investment options.

Regulations and Taxation: Foreigners must comply with specific regulations and reporting requirements when investing in US stocks. Some of the key aspects to consider include:

Withholding Tax: The United States imposes a 30% withholding tax on dividend and interest income earned by non-resident aliens. However, this rate may be reduced under tax treaties with certain countries.

Reporting: Foreigners must file Form 8938 if their financial assets, including stocks, exceed a certain threshold. Failure to comply with reporting requirements can result in penalties.

Capital Gains Tax: When selling US stocks, foreigners may be subject to capital gains tax. The tax rate depends on the holding period of the investment and the country of residence.

Case Study: Consider John, a resident of the United Kingdom, who decides to invest in US stocks. He opens a regular brokerage account and purchases shares in a well-known tech company. After a few years, the value of his investment has increased significantly, and he decides to sell. As a non-US resident, John is subject to the 30% withholding tax on dividends and capital gains tax on the sale of his shares.

Conclusion: Foreigners are indeed allowed to buy US stocks, but they must navigate the regulations and tax implications carefully. By understanding the various account types, complying with reporting requirements, and seeking professional advice, you can successfully invest in the US stock market and potentially achieve substantial returns.

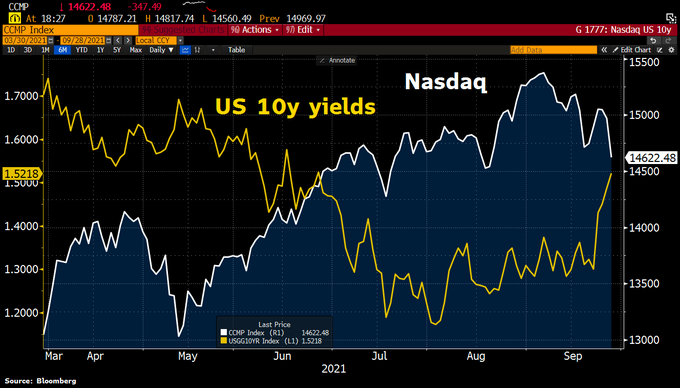

index nasdaq 100