Are you looking to enhance your investment portfolio with stocks that offer a steady monthly income? Monthly dividend stocks in the US can be a game-changer for investors seeking consistent and reliable returns. This article delves into the world of monthly dividend stocks, their benefits, and how you can identify the best ones for your portfolio.

Understanding Monthly Dividend Stocks

Monthly dividend stocks are shares of companies that distribute dividends to shareholders on a monthly basis, rather than the more common quarterly schedule. This can provide investors with a more frequent and predictable income stream. Investing in monthly dividend stocks can be particularly beneficial for those seeking to generate a regular income, such as retirees or those planning for long-term financial goals.

Benefits of Monthly Dividend Stocks

1. Consistent Income: The primary advantage of monthly dividend stocks is the consistent income they provide. This can be particularly appealing for investors who rely on their investments for income.

2. Potential for Higher Returns: Monthly dividend stocks often offer higher yields compared to their quarterly-paying counterparts. This can be a significant factor in maximizing your investment returns.

3. Stability: Companies that pay monthly dividends tend to be more stable and financially sound. This is because they have the resources to consistently distribute dividends to their shareholders.

How to Identify Monthly Dividend Stocks

1. Research and Analysis: Conduct thorough research on companies that pay monthly dividends. Look for companies with a strong financial track record, stable earnings, and a history of increasing dividends over time.

2. Dividend Yield: Consider the dividend yield of a stock. A higher dividend yield can indicate a potentially higher return on your investment.

3. Financial Health: Evaluate the financial health of the company, including their debt levels, revenue growth, and profitability.

Case Study: Realty Income (O)

Realty Income (O) is a prime example of a monthly dividend stock. This real estate investment trust (REIT) owns a portfolio of properties that generate rental income. Realty Income has a long history of paying monthly dividends and has increased its dividend for 92 consecutive years. This consistency makes it an attractive option for investors seeking a reliable monthly income.

Conclusion

Monthly dividend stocks in the US can be a valuable addition to your investment portfolio, providing a steady and predictable income stream. By conducting thorough research and analyzing the financial health of potential investments, you can identify the best monthly dividend stocks for your needs. Remember, diversifying your portfolio with a mix of dividend-paying stocks can help you achieve your long-term financial goals.

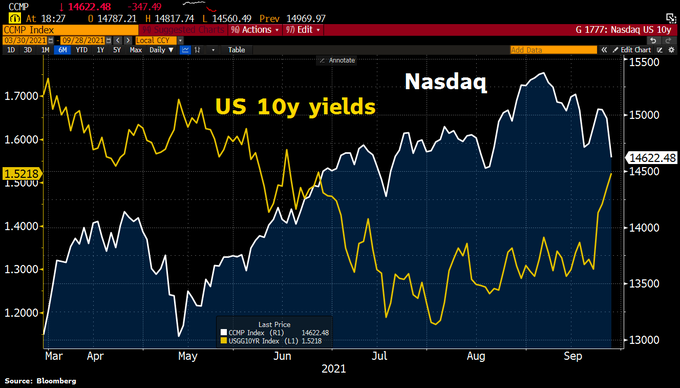

index nasdaq 100