The US election is a pivotal event that can significantly influence the stock market. As investors, it's crucial to understand how political changes can affect the market and make informed decisions. This article delves into the various ways in which the US election impacts the stock market, providing valuable insights for investors.

Political Stability and Market Sentiment

One of the primary ways the US election affects the stock market is through political stability. Investors tend to favor stable governments that can implement consistent economic policies. A stable government reduces uncertainty, leading to increased market confidence and potentially higher stock prices.

For instance, during the 2016 election, investors were uncertain about the outcome, leading to increased volatility in the stock market. However, once the results were announced, the market stabilized, reflecting the relief among investors.

Tax Policies and Corporate Profits

Tax policies are another critical factor influenced by the US election. Different political parties have varying views on taxation, which can directly impact corporate profits and, subsequently, stock prices.

For example, if a new administration implements lower corporate tax rates, it can lead to increased profits for companies, boosting stock prices. Conversely, higher tax rates can reduce profits and lead to lower stock prices.

Regulatory Changes

The US election can also lead to regulatory changes that impact various sectors of the economy. Different political parties have different views on regulation, which can affect industries such as healthcare, finance, and energy.

For instance, a more pro-regulatory administration may increase regulations on the financial sector, leading to lower stock prices for financial companies. Conversely, a less regulatory-friendly administration may reduce regulations, potentially leading to higher stock prices for these companies.

Trade Policies

Trade policies are another critical factor influenced by the US election. Different political parties have different views on trade, which can impact global supply chains and international trade agreements.

For example, a more protectionist administration may impose tariffs on imports, leading to higher costs for companies and potentially lower stock prices. Conversely, a more free-trade administration may reduce tariffs and trade barriers, potentially leading to higher stock prices.

Sector-Specific Impacts

The US election can also have sector-specific impacts. For example, a more environmentally conscious administration may invest in renewable energy, leading to higher stock prices for renewable energy companies. Conversely, a less environmentally conscious administration may invest in fossil fuels, potentially leading to higher stock prices for oil and gas companies.

Conclusion

The US election is a significant event that can have a profound impact on the stock market. Understanding the various ways in which the election can influence the market is crucial for investors. By staying informed and making informed decisions, investors can navigate the potential volatility and capitalize on opportunities presented by the US election.

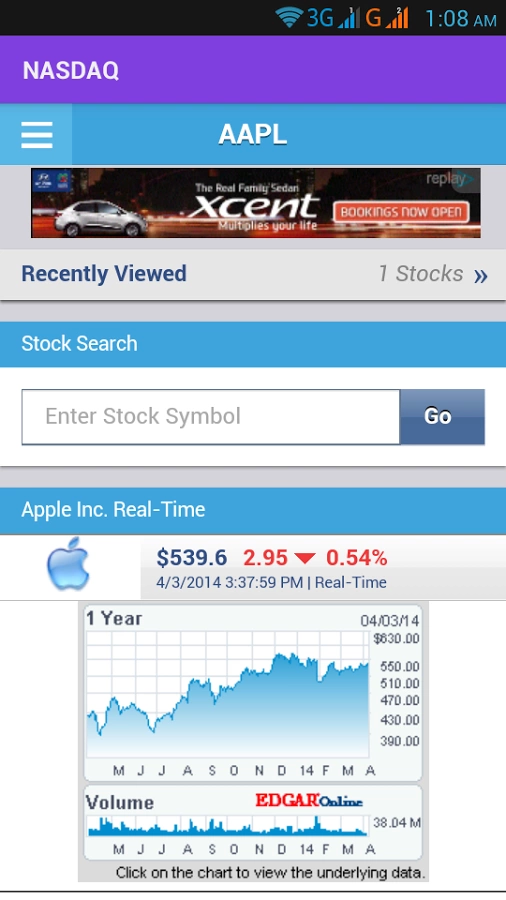

index nasdaq 100