Are you an Indian investor looking to expand your portfolio globally? Investing in US stocks can be a great way to diversify your investments and potentially benefit from the strong economic growth and stability of the United States. In this article, we will explore the steps Indian investors can take to invest in US stocks, including the various platforms available and the key considerations to keep in mind.

Understanding the Process

The first step for Indian investors interested in investing in US stocks is to understand the process. Here are the key steps involved:

Open a Foreign Exchange Account: To invest in US stocks, you will need to have a foreign exchange account that allows you to convert your Indian rupees to US dollars. Several Indian banks offer such accounts, and it's essential to compare the fees and exchange rates before choosing one.

Choose a Broker: Next, you will need to choose a brokerage firm that offers access to US stocks. Many reputable brokers, such as E*TRADE, TD Ameritrade, and Fidelity, cater to international investors. Be sure to research and compare the fees, available services, and customer support of different brokers.

Open an Account with the Broker: Once you have chosen a broker, you will need to open an account with them. This typically involves filling out an application form, providing identification and address proof, and funding your account with the required amount of money.

Convert Currency: After your account is funded, you can convert your Indian rupees to US dollars and use the funds to purchase US stocks.

Types of US Stocks

There are several types of US stocks that Indian investors can consider:

Common Stocks: These represent ownership in a company and come with voting rights. They can offer higher returns but come with higher risk.

Preferred Stocks: These offer fixed dividends and often have priority over common stocks in terms of receiving dividends and assets in the event of liquidation.

ETFs (Exchange-Traded Funds): These are a collection of stocks or bonds that trade on a stock exchange, similar to individual stocks. They can provide exposure to a wide range of assets with lower risk.

Key Considerations

When investing in US stocks, there are several key considerations to keep in mind:

Currency Risk: Fluctuations in the exchange rate between the Indian rupee and the US dollar can impact your investment returns. It's important to monitor the exchange rate and consider hedging strategies if necessary.

Tax Implications: Indian investors may be subject to taxes on their US stock investments. It's essential to understand the tax implications and consult with a tax professional if needed.

Market Volatility: The US stock market can be volatile, and it's important to have a well-diversified portfolio and a long-term investment horizon.

Research and Due Diligence: Conduct thorough research on the companies and sectors you are considering investing in. Look for companies with strong fundamentals and a good track record.

Case Study: Indian Investor Invests in US Tech Stocks

Let's consider a hypothetical case study of an Indian investor, Ravi, who decides to invest in US tech stocks. Ravi opens a foreign exchange account with a reputable bank, chooses a broker that offers access to US stocks, and opens an account with them. He funds his account with $10,000 and converts it to US dollars.

Ravi decides to invest in popular tech companies like Apple, Microsoft, and Google. He monitors the performance of his investments and adjusts his portfolio as needed. Over time, his investments grow, and he benefits from the strong performance of the US tech sector.

Conclusion

Investing in US stocks can be a valuable addition to an Indian investor's portfolio. By following the steps outlined in this article and considering the key factors, Indian investors can successfully invest in US stocks and potentially benefit from the strong economic growth and stability of the United States.

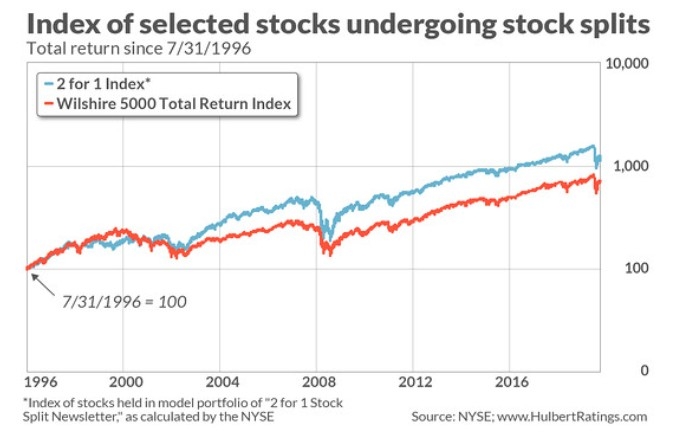

index nasdaq 100