The Dow Jones Industrial Average, often simply referred to as the "Dow," has been a benchmark for the stock market since its inception in 1896. Over the years, the Dow has seen numerous highs and lows, but none as remarkable as its highest closing point to date. This article delves into the factors that contributed to this historic milestone and examines the implications it has for investors and the economy.

A Record-Breaking Closing

On January 3, 2022, the Dow Jones Industrial Average closed at an all-time high of 36,596.77 points. This record-breaking close marked a significant milestone for the index, which has been a leading indicator of the overall health of the U.S. stock market for over a century.

Factors Contributing to the High

Several factors contributed to the Dow's record-breaking close. One of the primary drivers was the strong economic recovery following the COVID-19 pandemic. As the economy reopened, businesses saw increased demand for their products and services, leading to higher profits and, consequently, higher stock prices.

Additionally, the Federal Reserve's accommodative monetary policy played a crucial role. The Fed's low-interest-rate environment and quantitative easing programs helped to keep borrowing costs low, making it easier for businesses and consumers to access credit. This, in turn, fueled economic growth and supported stock prices.

Moreover, the rise of technology stocks, particularly those in the tech-heavy NASDAQ Composite, also contributed to the Dow's high. Many technology companies have seen significant growth over the past few years, and their inclusion in the Dow has helped to drive the index higher.

Implications for Investors

The Dow's record-breaking close has significant implications for investors. For those who are invested in the market, it represents a potential opportunity for capital gains. However, it's important to remember that past performance is not indicative of future results. Investors should be cautious and conduct thorough research before making investment decisions.

Moreover, the record high may indicate that the market is becoming overvalued. Some investors believe that the Dow's high close is a sign of excessive optimism and could be vulnerable to a correction. As such, it's crucial for investors to maintain a diversified portfolio and stay focused on their long-term investment goals.

Case Study: Apple's Contribution to the Dow

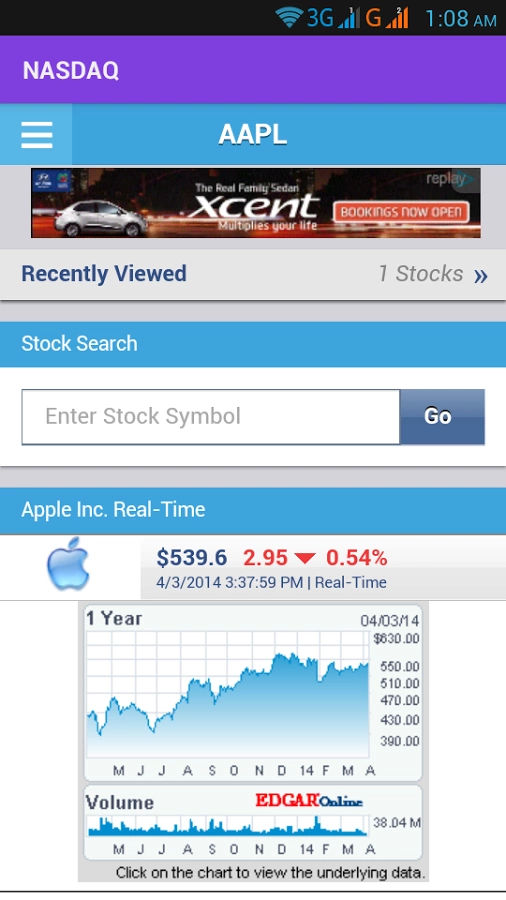

One of the key components of the Dow is Apple Inc., which has been a major driver of the index's growth. Over the past few years, Apple has seen substantial growth in its revenue and profits, which has helped to drive the Dow higher.

In 2020, Apple became the first publicly traded company to reach a market capitalization of $2 trillion. This milestone was a testament to the company's success and its impact on the stock market. Apple's inclusion in the Dow has helped to bolster the index's performance and contribute to its record-breaking close.

Conclusion

The Dow Jones Industrial Average's record-breaking close is a significant milestone for the stock market. While it represents a potential opportunity for investors, it's important to approach the market with caution and maintain a diversified portfolio. As the economy continues to recover and technology stocks remain a driving force, the Dow's future performance will remain a key indicator of the market's health.

index nasdaq 100