In a surprising turn of events, the United States credit rating was recently downgraded by a major rating agency, causing a stir in the financial markets. This article delves into the implications of this downgrade and examines the stock market's reaction to it.

Understanding the Downgrade

The US credit rating downgrade occurred after the country's government faced numerous economic and political challenges. The rating agency highlighted the rising national debt and the lack of a clear plan to address it as primary reasons for the downgrade. This move sent shockwaves through the financial community, prompting many to question the stability of the US economy.

Impact on the Stock Market

The stock market's reaction to the credit rating downgrade was swift and significant. Investors, already concerned about the economic outlook, sold off stocks en masse, leading to a sharp decline in market indices. The S&P 500, a widely followed benchmark for US stocks, saw a particularly steep drop.

Reasons for the Stock Market Drop

Several factors contributed to the stock market's reaction to the downgrade:

Economic Uncertainty: The downgrade raised concerns about the long-term economic stability of the United States. This uncertainty led investors to sell off stocks in favor of safer assets, such as government bonds.

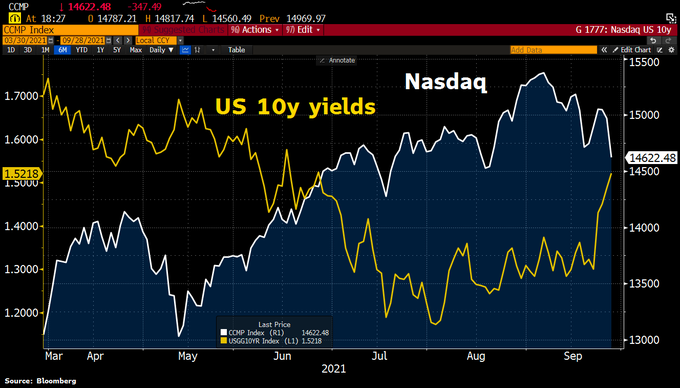

Interest Rate Concerns: The downgrade raised the possibility of higher interest rates in the future. Higher interest rates can hurt corporate profits and consumer spending, leading to a decline in stock prices.

Political Uncertainty: The downgrade also highlighted the political challenges facing the US government. Investors are concerned about the possibility of gridlock and the inability of policymakers to address critical economic issues.

Case Studies

Several high-profile companies and sectors were affected by the stock market downturn:

Technology Sector: The technology sector, which has been a major driver of stock market growth in recent years, saw significant declines. Companies like Apple and Microsoft saw their stock prices drop as investors moved away from risky assets.

Energy Sector: The energy sector also faced downward pressure due to the uncertainty surrounding global oil prices. Companies like ExxonMobil and Chevron saw their stock prices decline.

Conclusion

The US credit rating downgrade in 2023 has had a significant impact on the stock market. The rapid sell-off in stocks and the sharp decline in market indices highlight the market's sensitivity to economic and political uncertainty. While the long-term implications of the downgrade are still uncertain, it serves as a reminder of the interconnected nature of the global financial markets.

index nasdaq 100