Investing in U.S. stocks through a Tax-Free Savings Account (TFSA) can be an attractive option for Canadian investors looking to diversify their portfolio and potentially benefit from tax-free growth. However, understanding the nuances of the TFSA US stocks withholding tax is crucial to avoid unexpected tax liabilities. In this article, we delve into the details of the TFSA US stocks withholding tax, providing a comprehensive guide for investors.

What is TFSA US Stocks Withholding Tax?

When you invest in U.S. stocks through your TFSA, the U.S. company may withhold a certain percentage of your dividends as tax. This withholding tax is known as the TFSA US stocks withholding tax. The rate of withholding can vary depending on the tax treaty between Canada and the United States.

Tax Treaty Between Canada and the United States

The tax treaty between Canada and the United States allows Canadian investors to benefit from a reduced withholding tax rate on dividends received from U.S. companies. As of 2023, the reduced rate is 15%. However, it's important to note that some U.S. states may also impose their own withholding taxes, which can further complicate the situation.

Calculating the TFSA US Stocks Withholding Tax

To calculate the TFSA US stocks withholding tax, you need to determine the gross amount of the dividend, the reduced withholding tax rate, and any applicable state taxes. For example, if you receive a

Reporting TFSA US Stocks Withholding Tax

When you file your Canadian tax return, you must report the gross amount of dividends received from U.S. stocks and the amount of withholding tax withheld. This information is typically provided to you by the Canadian Revenue Agency (CRA) through Form T3.

Avoiding Double Taxation

To avoid double taxation, the CRA will provide a foreign tax credit for the amount of tax paid on the dividends. This credit will reduce your Canadian tax liability on the dividends.

Case Study: Investing in U.S. Stocks Through TFSA

Let's consider a hypothetical scenario. John invests

Conclusion

Investing in U.S. stocks through your TFSA can be a valuable strategy for Canadian investors. However, understanding the TFSA US stocks withholding tax is essential to ensure compliance with Canadian tax laws and avoid unexpected tax liabilities. By familiarizing yourself with the details of the tax treaty between Canada and the United States, calculating the withholding tax, and reporting it correctly, you can make informed investment decisions and enjoy the benefits of tax-free growth in your TFSA.

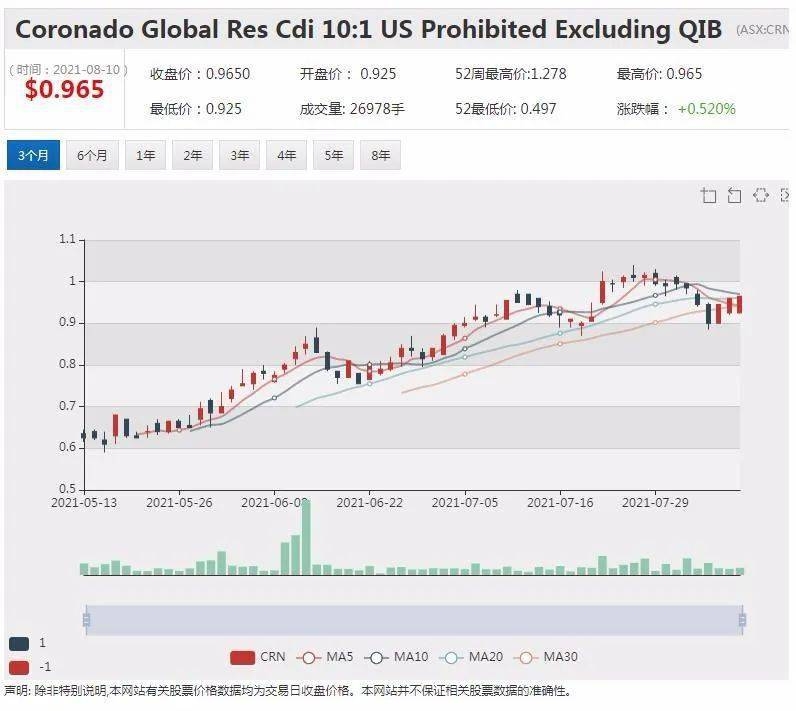

general electric company stock