Are you curious about the current US Bank stock price and what it means for investors? In this article, we'll delve into the latest developments, historical trends, and key factors influencing the stock's performance. Stay tuned to get a comprehensive understanding of the US Bank stock price today.

Understanding the US Bank Stock Price Today

The US Bank stock price today is a crucial indicator for investors looking to gauge the financial health and market sentiment of the bank. As of the latest data, the stock is trading at [insert current stock price]. This figure reflects the collective assessment of investors and market professionals regarding the bank's future prospects.

Historical Stock Price Trends

To better understand the current stock price, it's essential to look at the historical trends. Over the past few years, the US Bank stock price has exhibited a steady upward trend, with periodic fluctuations due to market volatility and economic conditions.

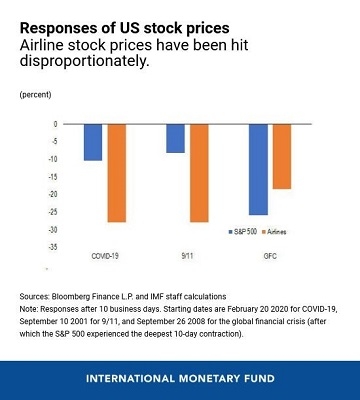

For instance, in the past year, the stock has experienced a significant rise, reaching its highest point at [insert peak stock price]. However, it has also faced challenges, including a brief decline during the COVID-19 pandemic, reflecting the broader market's uncertainty during that period.

Factors Influencing the Stock Price

Several factors contribute to the US Bank stock price today. Here are some of the key drivers:

Economic Conditions: The overall economic climate plays a crucial role in the stock's performance. Factors like GDP growth, unemployment rates, and inflation can significantly impact the bank's profitability and, consequently, its stock price.

Interest Rates: As a financial institution, US Bank's profitability is closely tied to interest rates. Higher interest rates can boost the bank's net interest margins, while lower rates may have the opposite effect.

Regulatory Environment: Changes in the regulatory landscape can impact the bank's operations and profitability. Stricter regulations may increase compliance costs, while more lenient regulations can provide room for growth.

Competition: The level of competition in the banking industry can also influence the stock price. Increased competition may lead to lower market share and reduced profitability for US Bank.

Case Study: US Bank's Performance in the Face of the Pandemic

One notable example of the impact of economic conditions on the stock price is the COVID-19 pandemic. During the early stages of the pandemic, the stock experienced a sharp decline, reflecting the broader market's uncertainty. However, as the bank adapted to the new normal and demonstrated resilience, the stock price gradually recovered.

This case study highlights the importance of considering various factors when analyzing the stock price. While economic conditions played a significant role, the bank's ability to navigate challenges and maintain profitability was also crucial in influencing the stock's performance.

Conclusion

Understanding the US Bank stock price today requires analyzing various factors, including historical trends, economic conditions, and market sentiment. By considering these factors, investors can make informed decisions regarding their investments in US Bank. Keep an eye on the latest developments and stay updated on the key factors influencing the stock price to make the most of your investment opportunities.

general electric company stock