In today's globalized economy, investors from the United Arab Emirates (UAE) are increasingly looking to diversify their portfolios by trading U.S. stocks. The allure of the American stock market, known for its liquidity, diversity, and potential for high returns, makes it an attractive destination for investors worldwide. This article provides a comprehensive guide to trading U.S. stocks in the UAE, covering everything from regulatory requirements to the best platforms for execution.

Understanding the Regulatory Landscape

Before delving into the specifics of trading U.S. stocks in the UAE, it's essential to understand the regulatory landscape. The UAE has specific regulations and requirements for foreign investors, particularly when it comes to trading international securities. The Dubai Financial Services Authority (DFSA) and the Abu Dhabi Global Market (ADGM) are the primary regulatory bodies overseeing financial services in the UAE.

Foreign investors must comply with the Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. Additionally, they must have a brokerage account with a regulated financial institution authorized to trade U.S. stocks.

Choosing the Right Brokerage Platform

Selecting the right brokerage platform is crucial for successful trading. The ideal platform should offer access to a wide range of U.S. stocks, competitive fees, and reliable customer support. Here are some popular brokerage platforms for trading U.S. stocks in the UAE:

Research and Analysis

Before placing a trade, it's crucial to conduct thorough research and analysis. This includes analyzing the company's financial statements, understanding its business model, and keeping an eye on market trends and economic indicators. Investors can use various financial analysis tools and market research platforms to gather information and make informed decisions.

Execution and Risk Management

Once you've done your research and analysis, it's time to execute your trade. It's important to set appropriate stop-loss and take-profit levels to manage risk and protect your investment. Additionally, consider using limit orders to ensure your trades are executed at the desired price.

Case Studies

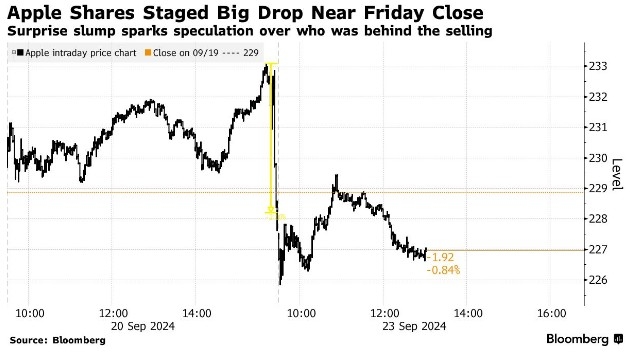

Let's consider a hypothetical case study to illustrate the process of trading U.S. stocks in the UAE. Imagine an investor named Ahmed wants to invest in Apple Inc. (AAPL). After conducting thorough research, Ahmed decides to buy 100 shares of AAPL at

Ahmed executes his trade through a regulated brokerage platform, and his order is filled at

Conclusion

Trading U.S. stocks in the UAE requires careful planning, research, and execution. By understanding the regulatory landscape, choosing the right brokerage platform, conducting thorough research, and managing risk effectively, investors can successfully diversify their portfolios and benefit from the potential returns of the American stock market.

general electric company stock