In the dynamic world of finance, investors are constantly seeking opportunities to diversify their portfolios. One of the most significant decisions involves choosing between international stocks and US stocks. As we delve into 2025, this article provides a comprehensive guide to help you understand the key differences and potential benefits of each.

Understanding International Stocks

International stocks refer to shares of companies based outside of the United States. These stocks offer investors exposure to diverse markets, currencies, and sectors. Some of the advantages of investing in international stocks include:

Understanding US Stocks

On the other hand, US stocks represent shares of companies based in the United States. The US stock market is one of the largest and most developed in the world, offering a wide range of investment opportunities. Some of the benefits of investing in US stocks include:

Comparing International Stocks vs US Stocks in 2025

As we approach 2025, several factors can influence the performance of international stocks versus US stocks:

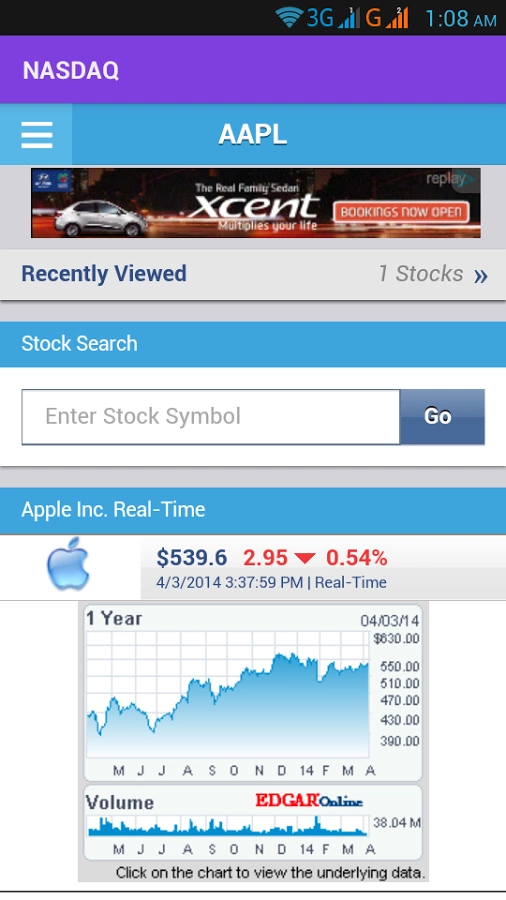

Case Study: Apple Inc.

One of the most notable examples of a US stock that has performed well over the years is Apple Inc. (AAPL). Despite facing competition from international companies like Samsung, Apple has continued to grow and innovate, making it a valuable addition to any diversified portfolio.

In contrast, investing in international stocks like Samsung Electronics (005930.KS) can offer exposure to a different market and sector. However, investors must be aware of the potential risks associated with investing in foreign markets, such as currency fluctuations and political instability.

Conclusion

As investors prepare for 2025, the decision between international stocks and US stocks depends on various factors, including individual risk tolerance, investment goals, and market conditions. By understanding the key differences and potential benefits of each, investors can make informed decisions to diversify their portfolios effectively.

general electric company stock