In the ever-evolving world of finance, investing in the US stock market has become a popular choice for investors around the globe. The term "ISA US stock" refers to a British Individual Savings Account (ISA) that allows investors to hold U.S. stocks while enjoying tax advantages. This article delves into the details of investing in ISA US stocks, highlighting the benefits, risks, and how to get started.

Understanding ISA US Stock

An ISA US stock is essentially a UK-based Individual Savings Account that enables investors to purchase American shares. Unlike regular stock investments, ISA US stocks are held within a tax-advantaged account, meaning investors are not taxed on the gains or dividends earned from these investments. This makes it an attractive option for UK residents looking to diversify their investment portfolio.

Benefits of Investing in ISA US Stocks

Tax-Free Gains: The most significant benefit of an ISA US stock is the tax-free nature of gains and dividends. This means investors can potentially keep more of their earnings, leading to higher overall returns.

Diversification: Investing in U.S. stocks through an ISA US stock allows investors to diversify their portfolio beyond UK-based investments. This can help reduce risk and potentially increase returns.

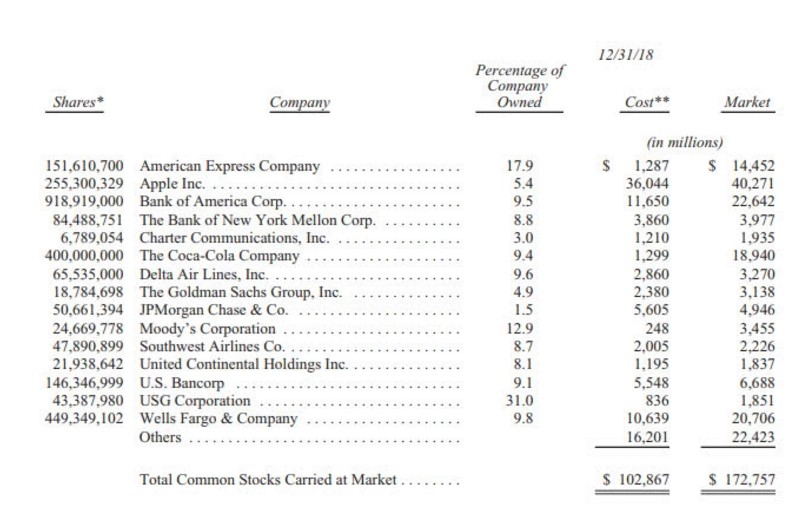

Access to World-Class Companies: The U.S. stock market is home to some of the world's largest and most successful companies. By investing in ISA US stocks, investors can gain exposure to these companies, potentially leading to higher returns.

Potential for High Returns: Historically, the U.S. stock market has provided some of the highest returns for investors. Investing in ISA US stocks can be a way to capitalize on this potential.

Risks of Investing in ISA US Stocks

While investing in ISA US stocks offers numerous benefits, it's important to be aware of the risks involved:

Market Volatility: The U.S. stock market can be highly volatile, leading to significant fluctuations in stock prices.

Currency Risk: Investing in U.S. stocks means being exposed to currency fluctuations. If the British pound strengthens against the U.S. dollar, investors may experience a loss when converting their gains back to pounds.

Lack of Control: When investing in U.S. stocks through an ISA, investors have less control over their investments compared to direct stock purchases.

How to Get Started with ISA US Stocks

To invest in ISA US stocks, follow these steps:

Open an ISA Account: Choose a UK-based ISA provider and open an ISA account.

Choose a Broker: Select a broker that offers access to U.S. stocks through your ISA account.

Research U.S. Stocks: Conduct thorough research to identify potential investments in U.S. stocks.

Invest: Once you've identified your desired stocks, purchase them through your ISA account.

Case Study: Investing in ISA US Stocks

Let's consider an example of investing in ISA US stocks. Imagine you have £10,000 to invest. After researching and identifying potential U.S. stocks, you decide to invest in Apple Inc. (AAPL). You purchase 10 shares at

Assuming the stock price increases to

Investing in ISA US stocks can be a valuable addition to your investment portfolio, offering tax-free gains, diversification, and access to some of the world's best companies. However, it's important to conduct thorough research and understand the risks involved before investing.

general electric company stock