Embarking on the journey to buy stocks in the US can be an exciting and potentially lucrative endeavor. However, for those new to the stock market, navigating through the various exchanges and understanding the intricacies of trading can seem daunting. If you're looking to invest in Canadian Securities Exchange (CSE) stocks, this guide will walk you through the process step-by-step.

Understanding the CSE

Firstly, it's essential to understand that the CSE, previously known as the Canadian Securities Exchange, is a stock exchange in Canada. While it operates in a different country, many US investors find CSE-listed stocks attractive due to their potential growth and diversification opportunities. The CSE is known for listing a wide range of companies, including technology, mining, and biotech sectors.

Step-by-Step Guide to Buying CSE Stocks in the US

1. Choose a Brokerage Firm

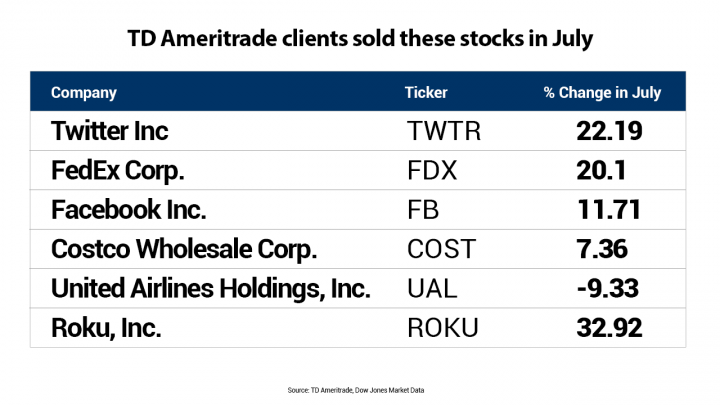

The first step is to choose a brokerage firm that allows you to trade on international exchanges. Some well-known brokerage firms that offer access to CSE stocks include TD Ameritrade, E*TRADE, and Charles Schwab. Research and compare the fees, platforms, and customer service of different brokers to find the one that suits your needs.

2. Open a Brokerage Account

Once you've chosen a brokerage firm, you'll need to open an account. This process typically involves providing personal information, such as your name, address, and Social Security number. You may also need to undergo a verification process, which can take a few days.

3. Fund Your Account

Next, you'll need to fund your brokerage account. You can do this by transferring funds from your bank account or by depositing a check. The amount you need to fund your account will depend on your investment strategy and the amount you want to invest in CSE stocks.

4. Research CSE Stocks

Before buying any stocks, it's crucial to research the company and its financials. This includes analyzing the company's revenue, profit margins, debt levels, and management team. You can find this information on financial websites, such as Yahoo Finance, Google Finance, and the company's own website.

5. Place a Trade

Once you've chosen a CSE stock to invest in, you can place a trade through your brokerage platform. Be sure to enter the correct stock symbol and the number of shares you want to buy. You can choose to buy a stock at the current market price or set a limit order to buy the stock at a specific price.

6. Monitor Your Investment

After buying a CSE stock, it's important to monitor its performance and stay informed about any news or developments that could impact its value. This will help you make informed decisions about buying, selling, or holding onto your investment.

Case Study: Investing in a CSE Stock

Let's say you're interested in investing in a CSE-listed biotech company. After researching the company and analyzing its financials, you decide to buy 100 shares at

Conclusion

Buying CSE stocks in the US can be a rewarding investment strategy. By following these steps and conducting thorough research, you can make informed decisions and potentially benefit from the growth of CSE-listed companies. Remember to always monitor your investments and stay informed about market trends.

general electric company stock