In the bustling financial markets of the United States, several stock indexes play a significant role in reflecting the overall health and performance of the nation's economy. Among them, two indexes have consistently caught the attention of investors, economists, and market analysts. This article delves into the details of these two influential stock indexes: the S&P 500 and the Dow Jones Industrial Average.

The S&P 500: A Benchmark of the Largest Companies in the US

The S&P 500 is a stock market index consisting of 500 large companies listed on the stock exchanges in the United States. This index is widely considered as a benchmark of the U.S. stock market, providing a snapshot of the performance of the largest and most influential companies across various sectors.

Key Points About the S&P 500:

The Dow Jones Industrial Average: A Historical Perspective

The Dow Jones Industrial Average (DJIA) is an index that tracks the performance of 30 large companies across various sectors, representing a cross-section of the U.S. economy. It was created in 1896 by Charles Dow, who aimed to provide a comprehensive measure of the U.S. stock market's performance.

Key Points About the DJIA:

Comparing the S&P 500 and the DJIA

While both the S&P 500 and the DJIA are widely followed stock indexes, there are several key differences between them:

Case Study: Impact of the S&P 500 and the DJIA on Market Trends

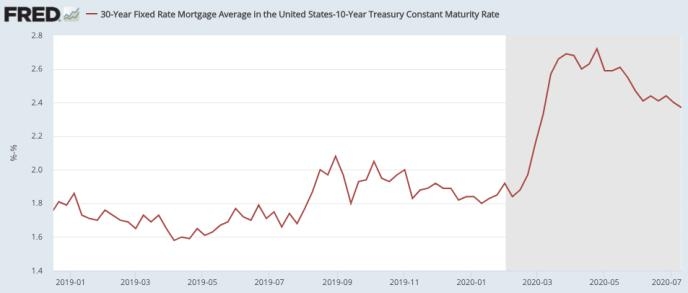

In 2020, the global stock market faced significant challenges due to the COVID-19 pandemic. Both the S&P 500 and the DJIA experienced sharp declines in the first half of the year. However, as the year progressed, the indexes began to recover, reflecting the resilience of the U.S. economy and the effectiveness of policy measures to mitigate the impact of the pandemic.

The S&P 500 and the DJIA both played a crucial role in capturing the market's performance during this period. The S&P 500's broader representation of the U.S. stock market provided a more accurate picture of the market's recovery, while the DJIA's focus on large-cap companies highlighted the resilience of the largest U.S. companies.

In conclusion, the S&P 500 and the DJIA are two of the most influential stock indexes in the United States. Their performance and composition provide valuable insights into the health and trends of the U.S. stock market and the broader economy. As investors, economists, and market analysts continue to monitor these indexes, they will remain key indicators of the U.S. financial markets.

general electric company stock